Black Knight: Past-Due Loans Continue to Improve

Black Knight, Jacksonville, Fla., said the national delinquency rate rose to 4.73% from 4.66% in April, although the increase was driven largely by the three-day Memorial Day weekend foreshortening available payment windows. Overall, it said past-due loan rates continued to improve.

The company’s monthly First Look Mortgage Monitor also reported early-stage delinquencies (those 30 or 60 days past due) rose by 110,200 in May, while serious delinquencies (90 or more days but not yet in foreclosure) improved for the ninth consecutive month.

Despite this improvement, the report said nearly 1.7 million first-lien mortgages remain seriously delinquent, 1.26 million more than there were prior to the pandemic.

Foreclosure inventory hit yet another record low as both moratoriums and borrower forbearance plan participation continue to limit activity, keeping foreclosure starts near record lows as well. Meanwhile, mortgage prepayments fell to their lowest level in more than a year, driven by falling refinance activity as well as purchase-related headwinds.

Other report data:

–Total Delinquency Rate (loans 30 or more days past due, but not in foreclosure): 4.73% in May, up by 1.51% from April but down by 39% from a year ago.

–Foreclosure Pre-Sale Inventory Rate: 0.28%, down by 2.46% from April and by 26.14% from a year ago.

–Foreclosure Starts: 3,800, up by 2.7% from April but down by 25.5 percent from a year ago.

–Monthly Prepayment Rate: 2.15%, down by 16.9% from April and by 6.26% from a year ago.

–Properties 30 or more days past due, but not in foreclosure: 2.511 million, up by 11,000 from April but down by 1.612 million from a year ago.

–Properties 90 or more days past due, but no in foreclosure: 1.669 million, down by 99,000 from April but up by 1.038 million from a year ago.

–Properties in foreclosure pre-sale inventory: 148,000, down by 5,000 from April and by 52,000 from a year ago.

–Properties 30 or more days past due or in foreclosure: 2.659 million, up by 6,000 from April but down by 1.665 million from a year ago.

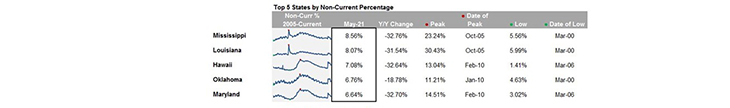

–States with the highest percentage of non-current loans: Mississippi, Louisiana, Hawaii, Oklahoma, Maryland.

–States with the lowest percentage of non-current loans: Idaho, Colorado, Washington, Utah, Montana.

–States with the highest percentage of 90-day-plus delinquencies: Mississippi, Louisiana, Hawaii, Nevada, Maryland.