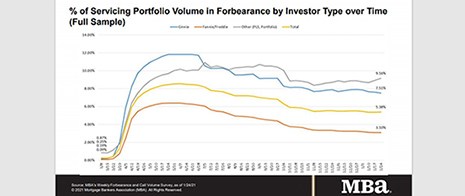

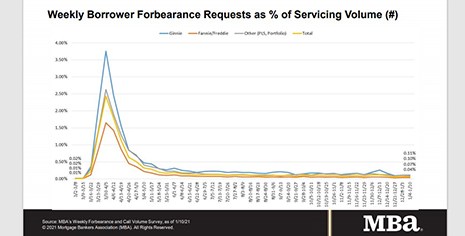

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

Tag: Mike Fratantoni

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

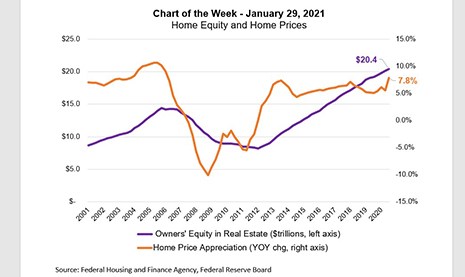

MBA Chart of the Week: Home Equity and Home Prices

Homeowners’ equity in housing was at a record high of $20.4 trillion in the third quarter. The steady upward trend since 2012 was spurred by accelerating home-price growth and low mortgage rates, which have helped many households build equity in their homes.

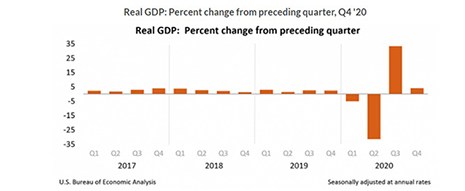

4th Quarter GDP Slows after Explosive 3Q Rebound

Gross domestic product increased at an annual rate of 4 percent in the fourth quarter, according to the “advance” estimate released yesterday by the Bureau of Economic Analysis.

FOMC Quietly Leaves Things Be

The first meeting of the Federal Open Market Committee during the Biden Administration was, as fitting, quiet and uneventful.

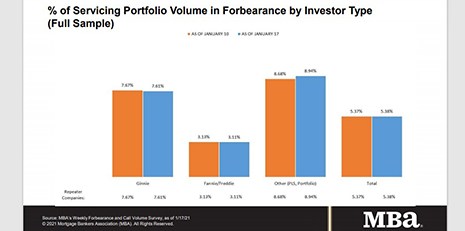

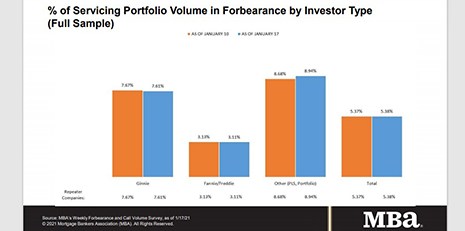

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

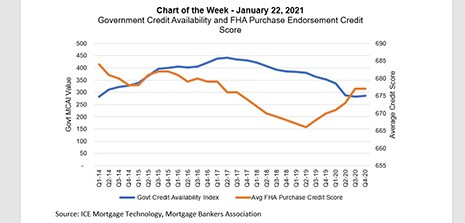

MBA Chart of the Week: Government Credit Availability & FHA Purchase Endorsement Credit Score

Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014.

MBA Chart of the Week: Government Credit Availability & FHA Purchase Endorsement Credit Score

Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.37%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell to 5.37% of servicers’ portfolio volume as of Jan. 10, compared to 5.46% the previous week. MBA estimates 2.7 million homeowners are in forbearance plans.