January Employment Picture Brightens a Little

Employers added 49,000 jobs in January, the Bureau of Labor Statistics reported Friday. And while the unemployment rate fell from 6.7% to 6.3%, Americans are still dealing with nearly 10 million jobs fewer than a year ago as a result of the coronavirus pandemic.

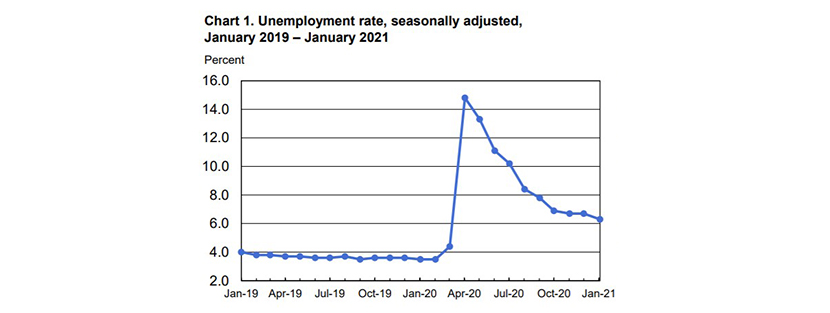

“The labor market continued to reflect the impact of the coronavirus (COVID-19) pandemic and efforts to contain it,” the report said. “In January, the unemployment rate fell by 0.4 percentage point to 6.3 percent, and the number of unemployed persons decreased to 10.1 million. Although both measures are much lower than their April 2020 highs, they remain well above their pre-pandemic levels in February 2020 (3.5 percent and 5.7 million, respectively).”

The change in total nonfarm payroll employment for November was revised down by 72,000, from +336,000 to +264,000, and the change for December was revised down by 87,000, from -140,000 to -227,000. With these revisions, employment in November and December combined was 159,000 lower than previously reported.

At 61.4 percent, the labor force participation rate was about unchanged over the month but is 1.9 percentage points lower than its February level. The employment-population ratio, at 57.5 percent in January, changed little over the month but is 3.6 percentage points lower than in February.

“Total employment rebounded in January following a decline in December, but the small increase leaves the economy with 6.5 percent fewer jobs than in February 2020,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “The job losses in December were concentrated in leisure and hospitality, and that continued last month, with gains overall hard to find outside of temporary help services. The increase in average weekly hours, coupled with the boost in hiring of temps, suggests that employers are poised to hire more over the next several months if the economy rebounds as we expect.

Fratantoni noted although the headline unemployment rate declined, there are still four million people who have been actively looking for work for 27 weeks or longer. “These are the workers that need additional support from the proposed stimulus bill, including enhanced unemployment benefits and direct payments,” he said.

Fratantoni added a key metric going forward will be construction employment, as builders ramp up their pace of homebuilding to meet strong demand. “While it was little changed in January, we do anticipate further growth in the sector this year, which will help to address the critical shortage of housing inventory on the market,” he said.

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said COVID’s impact on the labor market has been highly uneven. “High-contact service industries like leisure & hospitality have borne the brunt of social distancing efforts, while industries related to the goods side of the economy, including manufacturing, transportation and retail have held up significantly better,” she said. “The intense pressure on the leisure & hospitality was evident again in January, with employers cutting 61K jobs on top of the 536K jobs lost in December. Yet, weakness was more widespread in January and suggests that other industries are not fully insulted from the economy’s winter soft patch.”

Manufacturers, retailers and transport & warehousing companies all saw employment decline in January. While the Fed’s Beige Book and ISM surveys have highlighted staffing challenges for these industries recently, consumer spending on goods has also softened. Meanwhile, employment also declined in the healthcare industry. On net, the share of industries adding jobs sank to its lowest level since April.

On the plus, side, House said revisions to the establishment survey show that the jobs market is starting out on an even weaker footing this year. “While there is still a significant amount of ground to recover, we expect the labor market recovery to soon get back on track,” she said. “Vaccinations are picking up and additional fiscal relief should support employment directly through business aid and indirectly through aid to households. Warmer weather should also give a boost to food services and leisure employment as outdoor dining and other recreation activities become feasible. As health concerns ebb alongside the pandemic, we expect stronger hiring conditions to pull workers back into the labor market and for the participation rate to resume its recovery later this year.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said labor market momentum should pick up in the coming months with the dissemination of the vaccine and easing of business restrictions.

“Residential construction jobs continue to impress – with residential construction employment in January at its highest level since 2008,” Kushi said. “Jobs in residential construction employment increased nearly 2.2 percent in January relative to one year ago and are now nearly 1.0 percent above their pre-pandemic levels in February.”

The report said average hourly earnings for all employees on private nonfarm payrolls in January increased by 6 cents to $29.96. Average hourly earnings of private-sector production and nonsupervisory employees, at $25.18, changed little (+3 cents). The report said large employment fluctuations over the past several months—especially in industries with lower-paid workers—complicate the analysis of recent trends in average hourly earnings.

The average workweek for all employees on private nonfarm payrolls increased by 0.3 hour to 35.0 hours in January. In manufacturing, the workweek also increased by 0.3 hour to 40.4 hours, and overtime was unchanged at 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.2 hour to 34.4 hours.