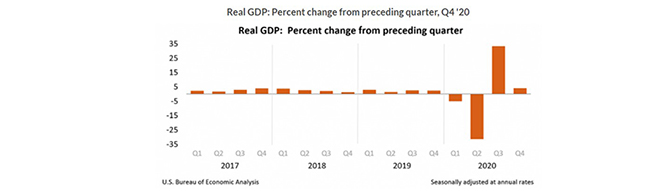

4th Quarter GDP Slows after Explosive 3Q Rebound

(Chart courtesy U.S. Bureau of Labor Statistics.)

Gross domestic product increased at an annual rate of 4 percent in the fourth quarter, according to the “advance” estimate released yesterday by the Bureau of Economic Analysis.

The results mark a substantial drop from the third quarter, when real GDP jumped by 33.4 percent, and marked the end of a volatile year in which the coronavirus wreaked havoc with the U.S. economy. Second-quarter GDP plunged by 31 percent, only to recover substantially by the third quarter.

The fourth quarter GDP estimate was based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the fourth quarter, based on more complete data, will be released on February 25.

BLS said the increase in real GDP reflected increases in exports, nonresidential fixed investment, personal consumption expenditures, residential fixed investment and private inventory investment, partly offset by decreases in state and local government spending and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

“The economy grew at a 4 percent annualized pace in the fourth quarter of last year, which was slower than the pace in the third quarter,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “The growth was led by business investment in new equipment and residential investment, both of which are a strong sign that companies and households are confident of a return to a more robust rate of activity in the year ahead. The spending on home construction is sorely needed, given the record low level of inventory in the housing market.”

Fratantoni noted the economy ended the year 2.5 percent smaller than at the end of 2019, marking the first annual decline since the Great Recession. “The outlook in 2021, with vaccine deployment picking up speed, makes us confident that we will see a strong rebound, particularly in the second half of the year,” he said. “Faster economic growth, fostered by supportive fiscal and monetary policy, will provide support for an improving job market and the continued, strong demand for housing.”

Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C., said growth in the first quarter likely will be significantly weaker. “Despite the 33.4% growth rate registered in Q3-2020 and the fourth quarter’s positive growth rate, the level of real GDP remains 2.5% below its pre-pandemic peak,” he said. “In short, the economy came into the fourth quarter of 2020 with significant momentum, but it clearly exited the quarter with loss of momentum. The spike in COVID cases in the last two months of 2020 led to the re-imposition of restrictions in some states as well as voluntary social distancing practices by many individuals, which weighed on consumer spending.”