MBA Chart of the Week: Government Credit Availability & FHA Purchase Endorsement Credit Score

Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014, as lenders remain more risk-averse, given elevated mortgage delinquency and forbearance rates, particularly for government loans.

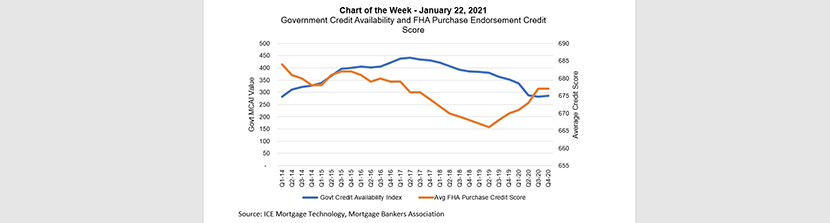

This week’s chart highlights the government credit availability index and the average credit score of an FHA home purchase endorsement. In the second quarter of 2020, government credit supply decreased 15 percent from the first quarter, and was 24 percent lower than the year before. In the four quarters preceding that, the average change in government credit supply was a decline of just over 3 percent. This drop in credit supply was mainly result of a decreased demand for streamline refinance programs and lender credit overlays, which effectively increased credit score requirements and lowered accepted LTV rates.

Similar to the overall credit index, government credit supply is currently at its tightest since 2014. This trend was consistent with a continued upward trend in the average credit score on FHA endorsements for home purchase mortgages. The average credit score moved to 673 in the second quarter of last year from 671 in the first quarter, and reached 677 in the fourth quarter – the highest average credit score since 2017.

FHA loans provide a low-down payment option for many buyers, and especially for first-time buyers, who account for over 80 percent of FHA purchase business. The decline in credit supply is impacting first-time buyers trying to reach the market.

MBA expects credit supply to increase in 2021 as the economic recovery continues, which should help first-timers. They are important to our forecast for purchase originations growth this year, along with the pandemic-related trend of households looking to move into larger, newer homes, and for some – in less-dense markets.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.