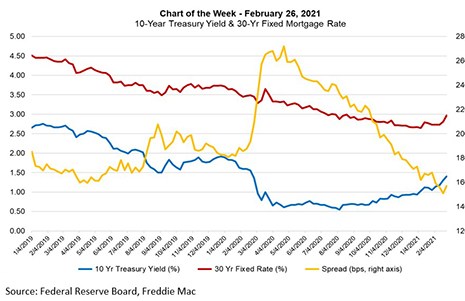

This week’s chart shows the recent climb in rates, and the spread between the 30-year mortgage rate, as surveyed by Freddie Mac, and the 10-year Treasury yield. As the 10-year has risen, so has the 30-year fixed rate, which has gone up 24 basis points since the beginning of February.

Tag: Mike Fratantoni

MBA Chart of the Week: 10-Year Treasuries and 30-Year Fixed Rates

This week’s chart shows the recent climb in rates, and the spread between the 30-year mortgage rate, as surveyed by Freddie Mac, and the 10-year Treasury yield. As the 10-year has risen, so has the 30-year fixed rate, which has gone up 24 basis points since the beginning of February.

MBA: Share of Mortgage Loans in Forbearance Declines to 5.22%

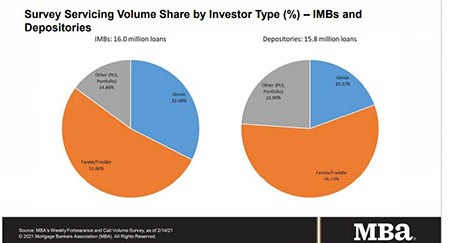

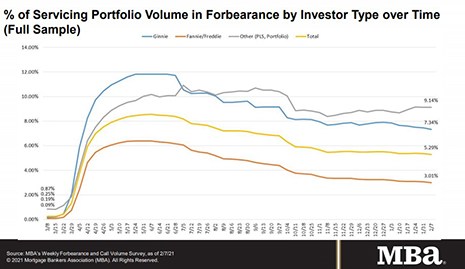

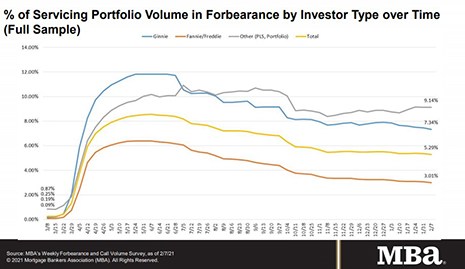

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 5.22% of servicers’ portfolio volume as of Feb. 14 compared to 5.29% the prior week. MBA estimates 2.6 million homeowners remain in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Declines to 5.22%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 5.22% of servicers’ portfolio volume as of Feb. 14 compared to 5.29% the prior week. MBA estimates 2.6 million homeowners remain in forbearance plans.

MBA: Loans in Forbearance Fall to 10-Month Low

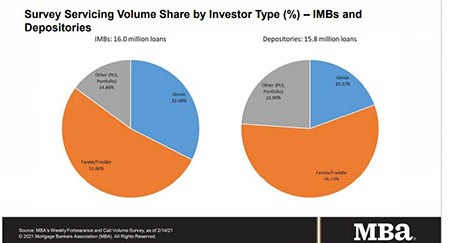

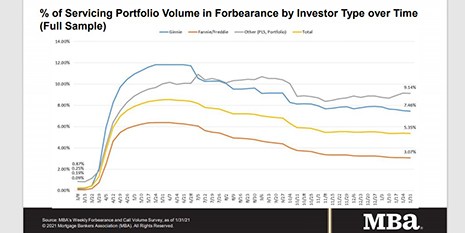

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.29% of servicers’ portfolio volume as of Feb. 7–the lowest percentage in more than 10 months.

MBA: Loans in Forbearance Fall to 10-Month Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.29% of servicers’ portfolio volume as of Feb. 7–the lowest percentage in more than 10 months.

MBA: Loans in Forbearance Fall to 5.35%

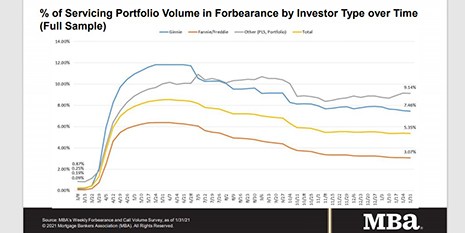

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall to 5.35%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

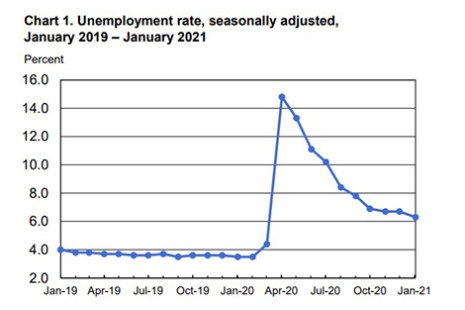

January Employment Picture Brightens a Little

Employers added 49,000 jobs in January, the Bureau of Labor Statistics reported Friday. And while the unemployment rate fell from 6.7% to 6.3%, Americans are still dealing with nearly 10 million jobs fewer than a year ago as a result of the coronavirus pandemic.

The Week Ahead—Feb. 8, 2021

Good morning! Welcome to another extraordinary week in Washington. Beginning Tuesday, Feb. 9, former President Donald Trump faces an historic second impeachment trial in the Senate.