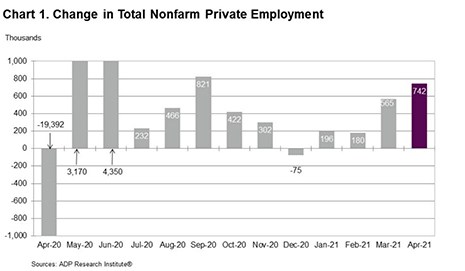

Ahead of this Friday’s Employment report from the Bureau of Labor Statistics and this morning’s Initial Claims report from the Labor Department, ADP, Roseland, N.J. said private-sector employment jumped by 742,000 jobs from March to April.

Tag: Mike Fratantoni

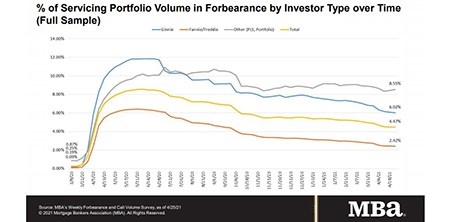

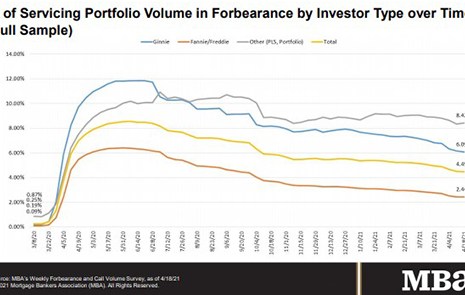

Share of Mortgage Loans in Forbearance Down 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 4.47% of servicers’ portfolio volume as of April 25 from 4.49% in the prior week, the ninth straight weekly decrease. MBA estimates 2.23 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Down 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 4.47% of servicers’ portfolio volume as of April 25 from 4.49% in the prior week, the ninth straight weekly decrease. MBA estimates 2.23 million homeowners are in forbearance plans.

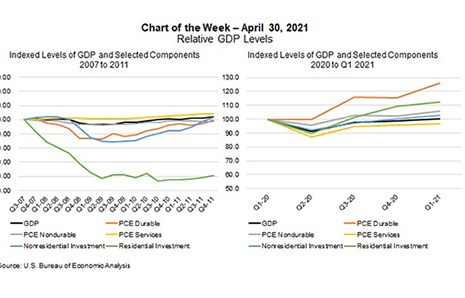

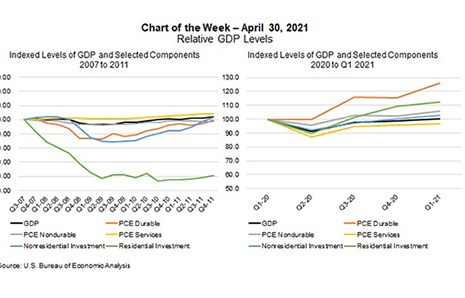

MBA Chart of the Week May 3, 2021: Relative GDP Levels

The pace of economic growth, as measured by gross domestic product in the first quarter, picked up to a 6.4 percent annualized rate – the biggest first-quarter increase since 1984.

MBA Chart of the Week: Relative GDP Levels

The pace of economic growth, as measured by gross domestic product in the first quarter, picked up to a 6.4 percent annualized rate – the biggest first-quarter increase since 1984. We expect that pace to accelerate further over the next 6 months, as households unleash the pent-up demand for a range of goods and services.

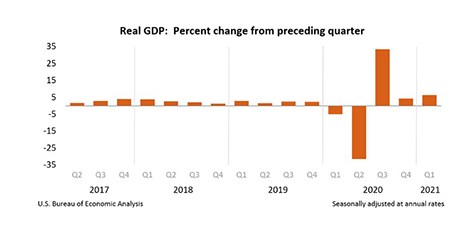

1Q GDP Report Shows Accelerating Economy

Real gross domestic product increased at an annual rate of 6.4 percent in the first quarter—the fastest such pace in more than 36 years—according to the first (advance) estimate released by the Bureau of Economic Analysis.

The Week Ahead—May 3, 2021

The Mortgage Bankers Association’s National Advocacy Conference is a little more than a week away. Offered through MBA LIVE, this is the largest advocacy event of the year focused solely on the issues facing you and the real estate finance industry.

1Q GDP Report Shows Accelerating Economy

Real gross domestic product increased at an annual rate of 6.4 percent in the first quarter—the fastest such pace in more than 36 years—according to the first (advance) estimate released yesterday by the Bureau of Economic Analysis.

Fed Statement Cites Ongoing Risks to Growing Economy

The Federal Open Market Committee yesterday, to no one’s surprise, left the federal funds rate unchanged at 0-0.25%. But analysts, including Mortgage Bankers Association Chief Economist Mike Fratantoni, were more interested in what the FOMC had to say about economic conditions and rising inflation.

MBA: Share of Mortgage Loans in Forbearance Dips to 4.49%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed little movement from the previous week. MBA said loans now in forbearance decreased by 1 basis point to 4.49% of servicers’ portfolio volume as of Apr 18 from 4.50% the prior week.