March Housing Starts Post at Highest Rate in 15 Years

(Chart courtesy HUD/Census Bureau.)

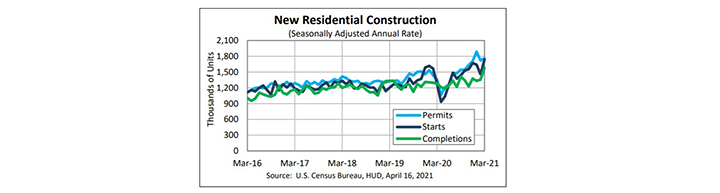

Housing starts recovered from a sluggish February to its highest rate since 2006 in March, HUD and the Census Bureau reported Friday.

The report said privately owned housing starts in March jumped to a seasonally adjusted annual rate of 1,739,000, 19.4 percent higher than the revised February estimate of 1,457,000 and 37 percent higher than a year ago (1,269,000). Single-family housing starts in March rose to 1,238,000, 15.3 percent higher than the revised February figure of 1,074,000. The March rate for units in buildings with five units or more rose to 477,000, up by 30 percent from February and by nearly 27 percent from a year ago.

Every region saw increases in housing starts except in the West, where starts fell by 13.6 percent to 380,000 units, seasonally annually adjusted, from 440,000 units in February. From a year ago, starts in the West improved by 19.5 percent.

In the South, starts rose by 13.5 percent in March to 874,000 units, seasonally annually adjusted, from 7770,000 units in February and improved by 24 percent from a year ago. In the Midwest, starts jumped by 122.8 percent in March to 303,000 units from 136,000 units in February and improved by 87 percent from a year ago. In the Northeast, starts jumped by 64 percent in March to 182,000 units from 111,000 units in February and improved by nearly 117 percent from a year ago.

“March job numbers showed a pickup in construction employment. Those job gains were matched by a notable increase in the pace of building,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “The biggest challenge facing the housing market right now is the lack of supply. This news of more new inventory on the way is very positive. Although we do not expect a rapid cooling in the pace of home-price growth, there should be some deceleration over the course of 2021 as these additional units enter the market.”

Housing starts rebounded from February’s weather-related weakness,” said Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “This past month’s rebound in housing starts should put to rest any debate about how much of February’s drop was due to the extreme weather that impacted Texas and other parts of the South and Midwest and how much was due to supply chain bottlenecks and soaring building materials prices. Unseasonably harsh winter weather was clearly the primary culprit.

Vitner noted home building had gotten off to a strong start in 2020 before the lockdown caused activity to plummet in April. “That soft patch will inflate year-to-date comparisons over the next couple of months,” he said. “Supply chain and issues and surging costs will continue to bedevil home builders this year, but we see construction finishing the year with an 8% gain and look for starts to come in a just under 1.5 million units.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said March housing starts data provided good news for a housing market parched for supply. “Single-family housing completions also increased to its fastest pace since 2007,” she said. An increase in completions mean more homes on the market in the short-term, providing immediate relief to home buyers in supply-constrained markets.”

The report said privately owned housing units authorized by building permits in March rose to a seasonally adjusted annual rate of 1,766,000, 2.7 percent higher than the revised February rate of 1,720,000 and 30.2 percent higher than a year ago (1,356,000). Single-family authorizations in March rose to 1,199,000, 4.6 percent higher than the revised February figure of 1,146,000. Authorizations of units in buildings with five units or more fell to 508,000 in March, down by 3.6 percent from February but up by 19.2 percent from a year ago.

HUD/Census said privately owned housing completions in March rose to a seasonally adjusted annual rate of 1,580,000, 16.6 percent higher than the revised February estimate of 1,355,000 and 23.4 percent higher than a year ago (1,280,000). Single-family housing completions in March rose to 1,099,000, 5.3 percent higher than the revised February rate of 1,044,000. The March rate for units in buildings with five units or more jumped to 476,000, up by 58.1 percent from February and by 30.4 percent from a year ago.