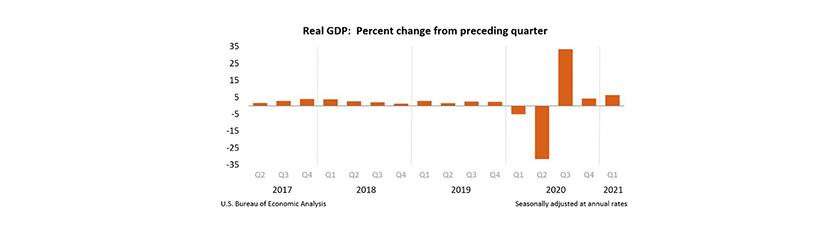

1Q GDP Report Shows Accelerating Economy

Real gross domestic product increased at an annual rate of 6.4 percent in the first quarter—the fastest such pace in more than 36 years—according to the first (advance) estimate released by the Bureau of Economic Analysis.

The GDP estimate is based on source data that are incomplete or subject to further revision by the source agency. BEA will make two further adjustments to first-quarter GDP in May and June. In the fourth quarter of 2020, real GDP increased 4.3 percent.

BEA said the increase in real GDP in the first quarter reflected increases in personal consumption expenditures, nonresidential fixed investment, federal government spending, residential fixed investment and state and local government spending, partly offset by decreases in private inventory investment and exports. Imports, a subtraction in the calculation of GDP, increased.

The report said the increase in PCE reflected increases in durable goods (led by motor vehicles and parts), nondurable goods (led by food and beverages) and services (led by food services and accommodations). The increase in nonresidential fixed investment reflected increases in equipment (led by information processing equipment) and intellectual property products (led by software). The increase in federal government spending primarily reflected an increase in payments made to banks for processing and administering the Paycheck Protection Program loan applications as well as purchases of COVID-19 vaccines for distribution to the public. The decrease in private inventory investment primarily reflected a decrease in retail trade inventories.

“The pace of economic growth picked up in the first quarter to a 6.4% annualized rate – the biggest first-quarter increase since 1984,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “We expect that pace to accelerate further over the next six months, as households unleash their pent-up demand for a range of goods and services. Consumer spending increased at more than a 10 percent annualized rate in the first quarter.”

Fratantoni noted residential investment increased at a similar rate. “This highlights the strong pace of housing construction we have seen in recent data, along with the brisk pace of home sales,” he said. “Housing construction is sorely needed, given the still quite low level of housing inventory and steep home-price growth.”

“Not only was the headline rate of GDP growth supported by strong consumer spending growth, but fixed investment spending also rose at a solid rate,” said Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C. “Real GDP growth could have been even stronger had inventories not fallen sharply. Looking forward, we expect that real GDP growth will remain robust due, in large part, to pent-up demand for many services and the mountain of excess savings that many households have accumulated. Indeed, 2021 likely will be the strongest year for U.S. real GDP growth in nearly 40 years.”