Total nonfarm employment increased by 850,000 in June, the Bureau of Labor Statistics reported Friday, well above expectations amid rising demand for services hit hard by the coronavirus pandemic.

Tag: Mike Fratantoni

MBA Weekly Applications Survey June 30, 2021: Apps Fall to Near 18-Month Low

Mortgage applications fell to their lowest level in nearly a year and a half amid volatile interest rate activity, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending June 25.

MBA Weekly Applications Survey June 30, 2021: Apps Fall to Near 18-Month Low

Mortgage applications fell to their lowest level in nearly a year and a half amid volatile interest rate activity, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending June 25.

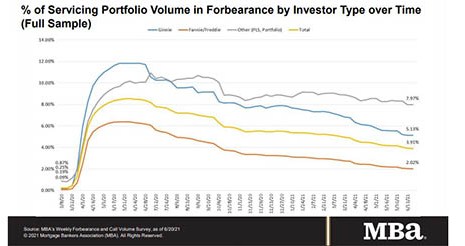

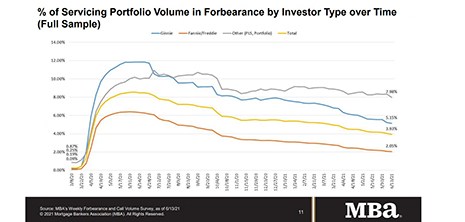

MBA: Share of Mortgage Loans in Forbearance Falls 17th Straight Week

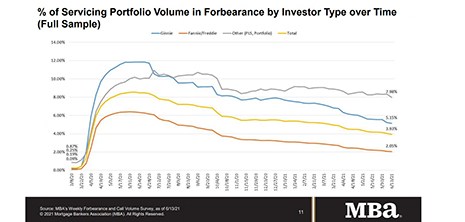

Loans in forbearance fell for the 17th straight week–and for the second straight week, remained below 4 percent–the Mortgage Bankers Association reported Monday.

MBA: Share of Mortgage Loans in Forbearance Falls 17th Straight Week

Loans in forbearance fell for the 17th straight week–and for the second straight week, remained below 4 percent–the Mortgage Bankers Association reported Monday.

Share of Mortgage Loans in Forbearance Falls Under 4%

The share of mortgage loans in forbearance fell for the 16th straight week and is now under 4 percent for the first time since onset of the coronavirus pandemic, the Mortgage Bankers Association reported Monday.

Share of Mortgage Loans in Forbearance Falls Under 4%

The share of mortgage loans in forbearance fell for the 16th straight week and is now under 4 percent for the first time since onset of the coronavirus pandemic, the Mortgage Bankers Association reported Monday.

Fed Sees Rising Economic Growth—and Inflation; Moves Up Rate Hike Timetable

The Federal Reserve isn’t raising interest rates anytime soon, but it did suggest Wednesday that the timetable for increases could begin sooner in 2023 if economic growth and inflation continue to rise faster than expected.

Share of Mortgage Loans in Forbearance Decreases to 4.04%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 12 basis points to 4.04% of servicers’ portfolio volume as of June 6 from 4.16% the prior week–the 15th consecutive week of declines.

Share of Mortgage Loans in Forbearance Decreases to 4.04%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 12 basis points to 4.04% of servicers’ portfolio volume as of June 6 from 4.16% the prior week–the 15th consecutive week of declines.