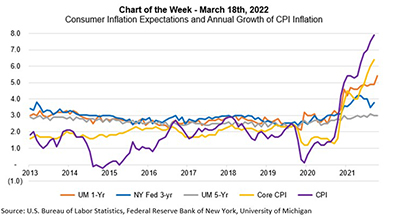

Inflation as measured by the Consumer Price Index reached an annual rate of nearly 8% in February. Over the past 12 months, inflation has increased steadily from less than 2% to 7.9%, compared to an average just under 2% in the five years prior.

Tag: Mike Fratantoni

Fed Approves 1st Rate Hike in 4 Years

The Federal Open Market Committee on Wednesday raised the federal funds rate for the first time since 2018, marking a new approach to rising inflation and other economic pressures.

Fed Approves 1st Rate Hike in 4 Years

The Federal Open Market Committee on Wednesday raised the federal funds rate for the first time since 2018, marking a new approach to rising inflation and other economic pressures.

Fed Approves 1st Rate Hike in 4 Years

The Federal Open Market Committee on Wednesday raised the federal funds rate for the first time since 2018, marking a new approach to rising inflation and other economic pressures.

The Week Ahead, Mar. 14, 2022: The Worst-Kept Secret in Washington and 5 Other Things to Know

Good morning and happy Monday! Here’s what’s happening in the real estate finance world this week:

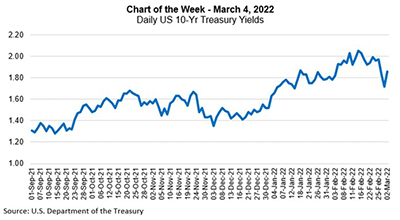

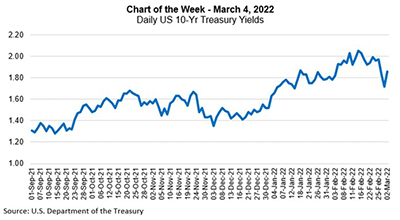

MBA Chart of the Week, Mar. 4, 2022: 10-Year U.S. Treasury Yields

Prior to Russia’s invasion, 10-Year Treasury yields broke higher — reaching 2.05% on February 15. Since then, they have fallen to as low as 1.72% but have rebounded somewhat, underscoring both the downside risk and volatility markets are facing.

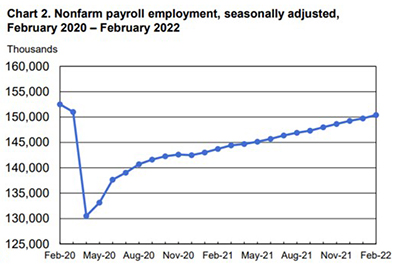

Strong February Jobs Report Gives Fed Momentum for March Rate Hike

For the second straight month, employment numbers beat expectations, with the Bureau of Labor Statistics reporting Friday that employment rose by 678,000 in February.

MBA Chart of the Week, Mar. 4, 2022: 10-Year U.S. Treasury Yields

Prior to Russia’s invasion, 10-Year Treasury yields broke higher — reaching 2.05% on February 15. Since then, they have fallen to as low as 1.72% but have rebounded somewhat, underscoring both the downside risk and volatility markets are facing.

The Week Ahead, Mar. 7, 2022: 4 Things to Know

Good morning and happy Monday! Here’s what’s happening in the real estate finance world this week:

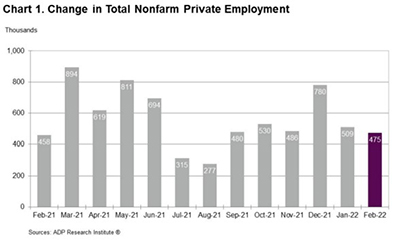

Employment Data Positive Ahead of Friday’s Jobs Report

Two key indicators of U.S. employment—the ADP National Employment Report and the Labor Department’s Initial Claims report—showed improvement ahead of this morning’s Employment report from the Bureau of Labor Statistics.