MBA Chart of the Week Mar. 18 2022: Consumer Inflation Expectations

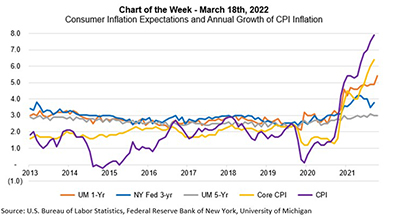

Inflation as measured by the Consumer Price Index reached an annual rate of nearly 8% in February.

Over the past 12 months, inflation has increased steadily from less than 2% to 7.9%, compared to an average just under 2% in the five years prior. Supply chain disruptions and goods shortages, combined with sustained consumer demand, continue to exert upward pressure on prices around the economy. Some price increases initially thought to be short-lived now seem likely to last longer than expected. Russia’s invasion of Ukraine has worsened the inflation picture, as that has caused additional strain on commodities prices and has created more uncertainty regarding the flow of goods around the world.

Consumer expectations for inflation in the next one-to-five years have also been rising in recent months, as shown by survey data collected by the Federal Reserve Bank of New York and the University of Michigan. Those expectations, as shown in the chart, have moved higher than in recent years. This is consequential because expectations of meaningful price changes impact spending, pricing, and compensation decisions.

To combat this accelerating inflation, the Federal Reserve this week raised its short-term rate target for the first time since 2018, and clearly signaled that additional rate hikes are coming, with the median FOMC member expecting to raise rates at each of the remaining six meetings in 2022. The FOMC economic projections indicated a strong job market with low unemployment, but slower growth and higher inflation than expected at the December meeting, while also expecting inflation to remain higher than its 2% goal past 2024.

Beyond the hike in short-term rates, the Fed also indicated that they plan to begin to shrink their balance sheet as soon as this summer, with Treasuries and MBS being allowed to passively roll off. We will be looking for details regarding the pace of the runoff and whether they would consider active MBS sales to return to an all-Treasury portfolio. While we still forecast that mortgage rates will increase to around 4.5% by the end of the year, rates have been exceptionally volatile in recent weeks, given the profound uncertainties both with respect to the geopolitical situation and monetary policy. Hopefully, the Fed’s actions and explanations can help to reduce the policy uncertainty, which would then diminish some of the current volatility.

- Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.