Strong February Jobs Report Gives Fed Momentum for March Rate Hike

For the second straight month, employment numbers beat expectations, with the Bureau of Labor Statistics reporting Friday that employment rose by 678,000 in February.

BLS reported widespread job growth in February, led by gains in leisure and hospitality, professional and business services, health care and construction The report also said the unemployment rate edged down to 3.8 percent.

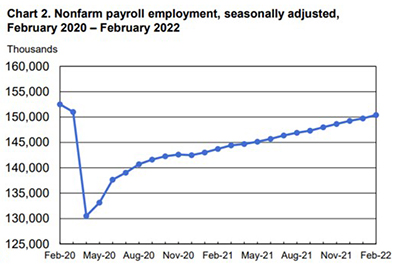

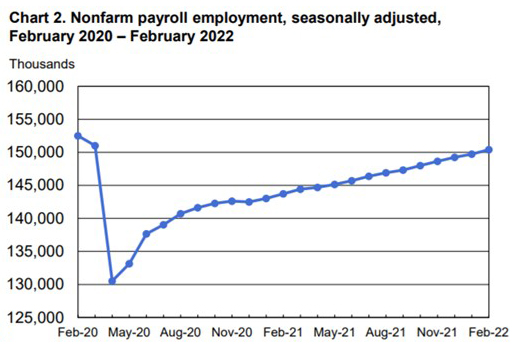

Despite the growth, employment remains down by 2.1 million, or 1.4 percent, from its pre-pandemic level in February 2020. Then, the unemployment rate was 3.5 percent and the number of unemployed persons was 5.7 million.

However, BLS revised up total nonfarm payroll employment for December by 78,000, from +510,000 to +588,000, and January by 14,000, from +467,000 to +481,000. With these revisions, employment in December and January combined is 92,000 higher than previously reported.

The labor force participation rate, at 62.3 percent in February, changed little over the month. The employment-population ratio edged up to 59.9 percent. Both measures remain below their February 2020 levels (63.4 percent and 61.2 percent, respectively).

“Job gains were strong again in February, with multiple aspects of the report highlighting a tight labor market,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “At 3.8%, the unemployment rate is likely lower than what can be sustained over the long run. With little change in labor force participation, the unemployment rate is likely to go lower in the months ahead, and we now expect it will dip below 3.5%, the very low level last reached in February 2020.”

Fratantoni noted there is only a 1.4% gap in the level of employment compared to February 2020. “At this pace, the gap could be closed in three months,” he said.

The report said construction jobs rose by 60,000, with gains in the categories for contractors. “Permits for new homes have increased, and now we see hiring picking up,” Fratantoni said. “However, supply chain constraints continue to pose a challenge for builders meeting the strong demand for new homes.”

Fratantoni added the report “is likely to reaffirm recent comments from Federal Reserve officials indicating that they still plan to increase rates at their upcoming March meeting, despite the market volatility stemming from the situation in Ukraine.”

“The strong pace of hiring comes as the availability of workers continues to improve,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The solid state of the labor market alongside the most significant inflation in decades leads us to believe that so long as the Russia-Ukraine conflict does not significantly escalate, the FOMC is poised to begin a tightening cycle on March 16.”

House noted February’s report showed further signs of workers stepping back into the jobs market and making it somewhat easier for businesses to hire. “This is not to say the labor market has reached nirvana,” she said. “Nonfarm payrolls are still 2.1 million below February 2020 levels, and the distribution of recouped jobs is uneven across different industries, regions and demographic groups. That said, the key limiting factor to faster job growth continues to be labor supply, even with the improvement of late, rather than labor demand.

“Overall, this was a good report,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The supply of workers continues to fall short of demand, but the underlying momentum of the labor market recovery is strong, and falling COVID case counts provide further forward momentum.”

Kushi noted residential building construction employment rose by 6,700 in February. “The rise is positive news for an industry that has been grappling with chronic labor shortages,” she said. “We need more homes built and, in such a labor-intensive industry, you need more workers to build more homes…the skilled labor shortage in the construction industry is not new – it’s been an issue for more than a decade now. However, there is some promising news this month: there have been eight straight months of gains in residential building, up 6.2% compared to pre-COVID. Attracting skilled labor remains a key priority.”

“Overall, we believe this report gives the Federal Reserve more than enough confidence in the labor market to start raising the policy rate at its meeting later this month,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C.

The report said average hourly earnings for all employees on private nonfarm payrolls, at $31.58 in February, were little changed over the month (+1 cent), after large increases in recent months. Over the past 12 months, average hourly earnings have increased by 5.1 percent. In February, average hourly earnings of private-sector production and nonsupervisory employees rose by 8 cents to $26.94.

The average workweek for all employees on private nonfarm payrolls rose by 0.1 hour to 34.7 hours in February. In manufacturing, the average workweek for all employees increased by 0.4 hour to 40.7 hours, and overtime rose by 0.2 hour to 3.6 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was up by 0.1 hour to 34.1 hours.

“Although average hourly earnings were little changed for the month, wages were up 5.1% over the past year, a strong pace, but still short of the price gains shown in the Consumer Price Index,” Fratantoni said. “The ongoing drop in initial claims for unemployment insurance is another facet of this historically strong job market.”

“The increased availability of workers appears to be taking the edge off current wage pressures,” House said. “While we suspect wage pressures will remain fairly strong in light of the overall tight state of the labor market, the easing in February reduces concerns about wage growth running away and taking inflation with it.”

The BLS report comes off of two other positive employment reports last week. On Wednesday, ADP, Roseland, N.J., reported private-sector employment increased by 475,000 jobs between January and February, nearly matching the previous month’s report. And BLS on Thursday reported initial claims for unemployment insurance fell by another 18,000 last week to the lowest total so far in 2022.

This Wednesday, BLS releases its monthly Job Opening and Labor Turnover Survey (JOLTS). Last month, the report showed employers had nearly 11 million job openings to fill.

And the next meeting of the Federal Open Market Committee meeting, in which Fed officials are widely expected to approve an increase in the federal funds rate of at least 25 basis points, takes place in Washington Mar. 15-16.