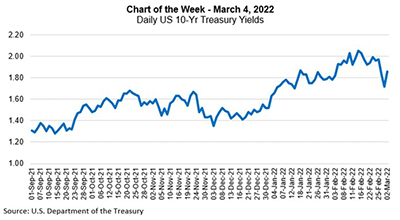

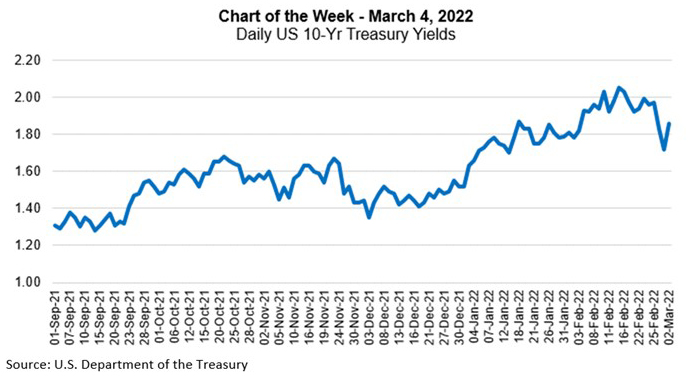

MBA Chart of the Week, Mar. 4, 2022: 10-Year U.S. Treasury Yields

On Thursday, February 24, Russian troops invaded Ukraine in an unprovoked assault on a peaceful neighbor. Through ground, sea and air attacks, the Russian military since then has killed countless Ukrainian citizens and kicked-off a massive dislocation as more than a million Ukrainians seek refuge in neighboring countries while millions more remain in Ukraine to defend their nation. The world has been inspired by their resolve and unity.

The most important questions about the current situation have to do with the safety, welfare and freedom of Ukrainians, and we and others will keep those issues front-and-center. At the same time, the unfolding events have direct and indirect impacts that are spreading out and affecting important aspects of the U.S. economy.

At MBA’s Annual and CREF Conventions – and in other industry discussions – we have noted that a long list of uncertainties – including geopolitical events – could impact the rate path. Foremost among them was the risk that the situation in Ukraine could result in a full-scale invasion, noting that if it did, rates would drop as a result of a flight to quality. It is certainly not yet clear if, how, or when this horrific situation may resolve, but each bit of news has the potential to impact rates.

MBA’s February Economic Forecast anticipated that real economic growth and inflation would both slow this year but remain above trend, and that 10-Year Treasury yields would grind higher, ending the year at 2.5%. Prior to Russia’s invasion, 10-Year Treasury yields broke higher — reaching 2.05% on February 15. Since then, they have fallen to as low as 1.72% but have rebounded somewhat, underscoring both the downside risk and volatility markets are facing.

Similarly, the magnitude of economic sanctions and the ways they play through the economy are likely to affect the paths of inflation, GDP growth and other economic fundamentals. West Texas Intermediate crude oil has topped $116 per barrel, the highest since 2008. In terms of implications for real estate markets, lower rates could promote single-family finance activity and support commercial real estate cap rates. Broader economic impacts may, or may not, counter some of those effects.

Events of the past two weeks have highlighted the significance of continuing economic uncertainties. Most importantly, however, they have put a spotlight on the safety, welfare and freedom of the Ukrainian people.

– Mike Fratantoni (mfratantoni@mba.org), Joel Kan (jkan@mba.org), Jamie Woodwell (jwoodwell@mba.org)