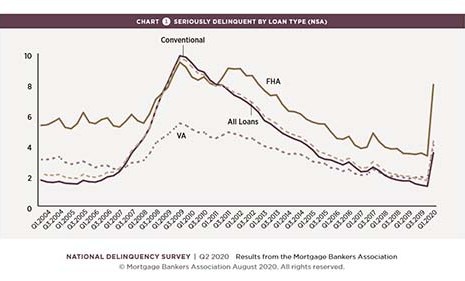

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

Tag: Marina Walsh

MBA Chart of the Week: Processing Times for HELOCs, Home Equity Loans

This week’s MBA Chart of the Week drills down on the U.S. Bureau of Economic Analysis’ advance estimate of real gross domestic product for the second quarter, which was released July 30.

MBA Advocacy Update Aug. 10, 2020

As congressional leaders and the administration remain deadlocked in negotiations on the next potential COVID-19 relief package, MBA’s advocacy on key federal regulatory and state-based actions has continued.

MBA: Home Equity Lending Growth Hindered by Alternative Products and COVID-19

Home equity loan debt outstanding and borrower utilization rates declined in 2019 and mortgage lenders anticipate originations to fall again this year before increasing modestly in 2021, the Mortgage Bankers Association reported.

Quote

“Households in 2019 remained hesitant to tap into the equity in their homes, despite several years of significant home-price appreciation resulting in sizable home equity gains.”

–MBA Vice President of Industry Analysis Marina Walsh.

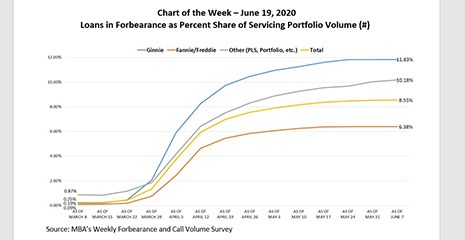

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

This week’s chart shows the course of the share of loans in forbearance by investor type over the past three months – from the earliest stages of the COVID-19 pandemic to the most recent reporting.

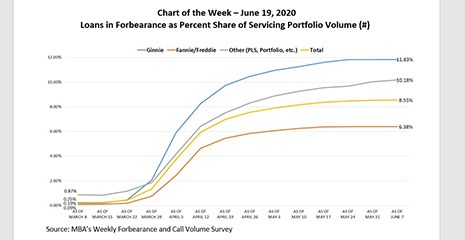

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

This week’s chart shows the course of the share of loans in forbearance by investor type over the past three months – from the earliest stages of the COVID-19 pandemic to the most recent reporting.

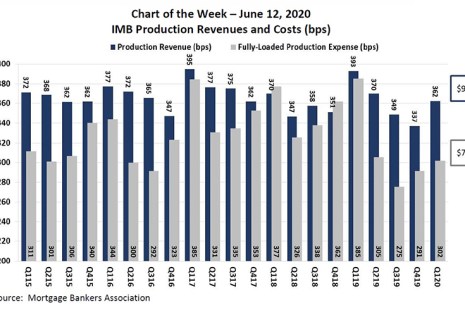

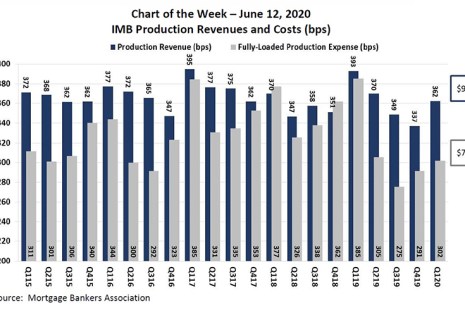

MBA Chart of the Week: IMB Production Revenues & Costs

MBA last week released its Quarterly Performance Report for the first quarter. The total sample of 336 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 61 basis points (or $1,600) on each loan they originated – a solid showing particularly for a first quarter.

MBA Chart of the Week: IMB Production Revenues & Costs

MBA last week released its Quarterly Performance Report for the first quarter. The total sample of 336 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 61 basis points (or $1,600) on each loan they originated – a solid showing particularly for a first quarter.

MBA: IMBs Report Strong First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.