MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

MBA said the delinquency rate increased by 386 basis points from the first quarter and by 369 basis points from one year ago.

“The COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent,” said Marina Walsh, MBA Vice President of Industry Analysis. “The nearly 4 percentage point jump in the delinquency rate was the biggest quarterly rise in the history of MBA’s survey. The second quarter results also mark the highest overall delinquency rate in nine years, and a survey-high delinquency rate for FHA loans.”

MBA asked servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

Walsh noted an increase in movement of loans to later stages of delinquency, with the 60-day delinquency rate reaching a new survey-high, and the 90+-day delinquency rate climbing to its highest level since the third quarter. “On a more positive note, 30-day delinquencies dropped in the second quarter, an indication that the flood of new delinquencies may be dissipating,” she said.

The report said mortgage delinquencies track closely with the availability of jobs. The five states with the largest quarterly increases in delinquency rates were New Jersey, Nevada, New York, Florida, and Hawaii – all with a prevalence of leisure and hospitality jobs that were especially hard-hit by the COVID-19 pandemic.

“The job market has improved over the past three months, with the unemployment rate falling for the third straight month from an April peak of 14.7 percent to 10.2 percent in July,” Walsh said. “This bright spot in the jobs picture is tempered by numerous uncertainties, including the ambiguous status of enhanced unemployment benefits and other stimulus measures, the recent surge in new COVID-19 cases, and the retrenchment from reopening in certain states. And there is no way to sugarcoat a 32.9 percent drop in GDP during the second quarter. Certain homeowners, particularly those with FHA loans, will continue to be impacted by this crisis, and delinquencies are likely to stay at elevated levels for the foreseeable future.”

Fortunately, Walsh said, several mitigating factors make the current spike in mortgage delinquencies different from the Great Recession; these factors include home-price gains, several years of home equity accumulation and the loan deferral and modification options that present alternatives to foreclosure for distressed homeowners.

Key findings of the MBA Second Quarter 2020 National Delinquency Survey:

–Compared to the first quarter, the seasonally adjusted total mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate decreased by 33 basis points to 2.34 percent; the 60-day delinquency rate increased by 138 basis points to 2.15 percent (the highest rate since the survey began in 1979); and the 90-day delinquency bucket increased 279 basis points to 3.72 percent, the highest rate since third quarter 2010.

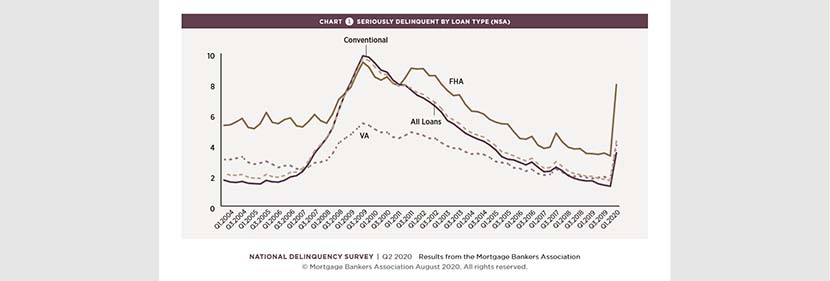

–By loan type, the total delinquency rate for conventional loans increased by 352 basis points to 6.68 percent over the previous quarter, the highest rate since third quarter 2012. The FHA delinquency rate increased by 596 basis points to 15.65 percent, the highest rate since the survey began in 1979. The VA delinquency rate increased by 340 basis points to 8.05 percent over the previous quarter, the highest rate since third quarter 2009.

–On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased by 307 basis points for conventional loans; by 643 basis points for FHA loans; and by 381 basis points for VA loans.

–The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter fell to 0.68 percent, down 5 basis points from the first quarter and by 22 basis points from one year ago.

–The percentage of loans on which foreclosure actions were started in the second quarter fell by 16 basis points from the first quarter to 0.03 percent.

–The seriously delinquent rate—the percentage of loans 90 days or more past due or in the process of foreclosure—increased to 4.26 percent, the highest rate since fourth quarter 2014. It increased by 259 basis points from last quarter and increased by 231 basis points from last year. The seriously delinquent rate increased by 219 basis points for conventional loans; by 467 basis points for FHA loans; and by 218 basis points for VA loans. From a year ago, the seriously delinquent rate increased by 184 basis points for conventional loans; by 453 basis points for FHA loans; and by 217 basis points for VA loans.

–States with the largest quarterly increases in the overall delinquency rate were New Jersey (628 basis points), Nevada (600 basis points), New York (575 basis points), Florida (569 basis points) and Hawaii (525 basis points).

–Note: An estimated 4.2 million homeowners were on forbearance plans as of June 28. For the purposes of this survey, MBA asks servicers to report the loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

To purchase the survey, visit www.mba.org/NDS or e-mail MBAResearch@mba.org.