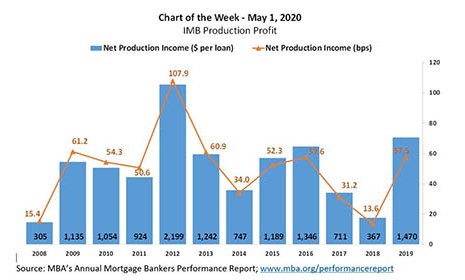

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

Tag: Marina Walsh

MBA: IMBs Report Strong First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

A ‘Truly Unprecedented’ Time for Economy, Mortgage Industry

WASHINGTON, D.C.–The current economic situation is ‘unprecedented,’ said MBA Chief Economist Mike Fratantoni during the MBA Live: State of the Industry virtual conference on Tuesday.

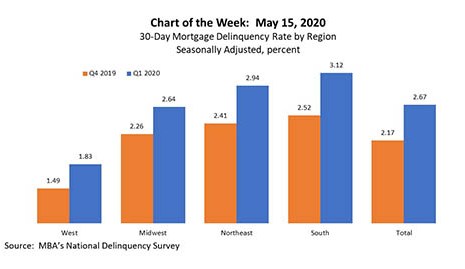

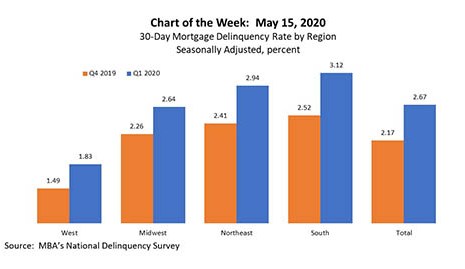

MBA Chart of the Week: 30-Day Mortgage Delinquency Rate by Region

MBA released its latest National Delinquency Survey for first quarter 2020 earlier this week. At the end of the first quarter, the delinquency rate for mortgage loans on one-to-four-unit residential properties jumped by 59 basis points to a seasonally adjusted rate of 4.36 percent of all loans outstanding.

Adapting to a Changing World; MBA LIVE: State of the Industry Online Conference Today

MBA’s first virtual conference takes place on Tuesday, May 19, from 1:00-5:00 p.m. ET. MBA Live: State of the Industry features presentations from key industry voices and MBA’s team of economists and policy/advocacy experts. The conference is free to MBA members.

MBA Chart of the Week: 30-Day Mortgage Delinquency Rate by Region

MBA released its latest National Delinquency Survey for first quarter 2020 earlier this week. At the end of the first quarter, the delinquency rate for mortgage loans on one-to-four-unit residential properties jumped by 59 basis points to a seasonally adjusted rate of 4.36 percent of all loans outstanding.

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.

MBA Chart of the Week: IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of 58 basis points ($1,470 on each loan they originated) in 2019, up from 14 basis points ($367 per loan) in 2018, according to the MBA Annual Mortgage Bankers Performance Report, released last month.