In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

Tag: Marina Walsh

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

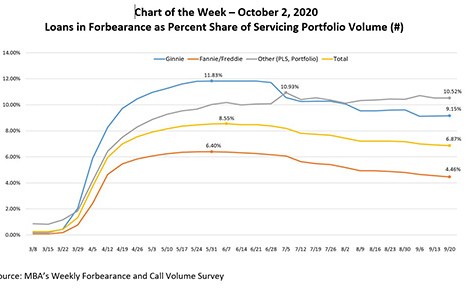

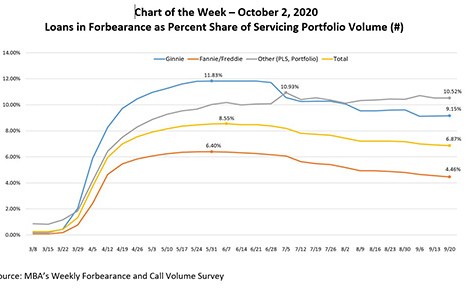

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, released last week, the share of loans in forbearance dropped to 6.87 percent of servicers’ portfolio volume as of September 20. The share was the lowest point since mid-April, and 168 basis points below a peak of 8.55 percent during the week ending June 7.

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, released last week, the share of loans in forbearance dropped to 6.87 percent of servicers’ portfolio volume as of September 20. The share was the lowest point since mid-April, and 168 basis points below a peak of 8.55 percent during the week ending June 7.

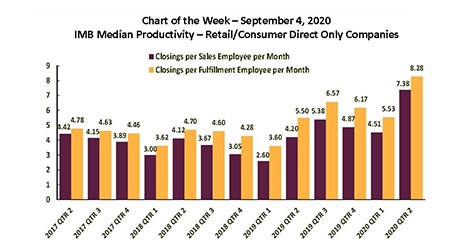

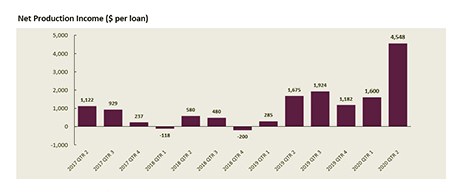

MBA Chart of the Week: Independent Mortgage Bank Median Productivity

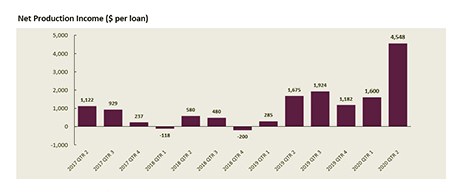

MBA last week released its latest Quarterly Performance Report for the second quarter. The report showed a record-high average for net production profit of 167 bps ($4,548 per loan), as well as record-high average origination volume of $1.02 billion per company.

MBA: Strong Borrower Demand, Low Rates Fuel 2Q IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

MBA: Strong Borrower Demand, Low Rates Fuel 2Q IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

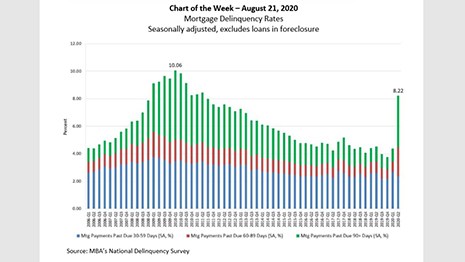

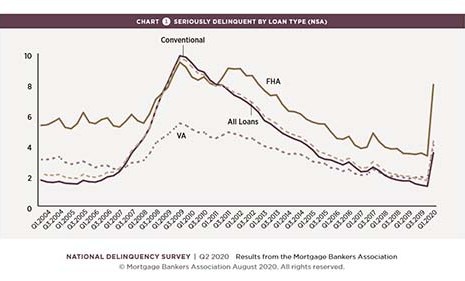

MBA Chart of the Week: Mortgage Delinquency Rates

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

MBA Chart of the Week: Mortgage Delinquency Rates

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.