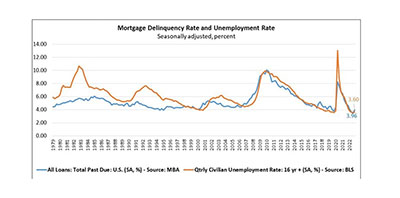

Mortgage delinquencies rose to near 4 percent in the fourth quarter, the Mortgage Bankers Association reported Thursday, but remained near survey lows.

Tag: Marina Walsh CMB

(IMB23) Mortgage Market Outlook: Volatility, Trending Toward Stability

CORONADO, Calif.—Inflation. Higher interest rates. Rising home prices. Market uncertainty. If 2022 threw independent mortgage bankers a curve ball, 2023 already appears to be tossing a knuckleball.

Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in December

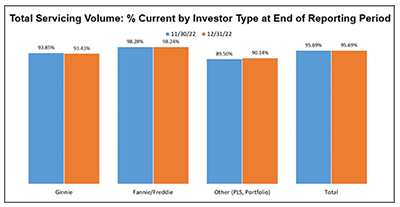

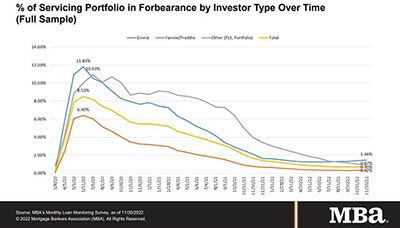

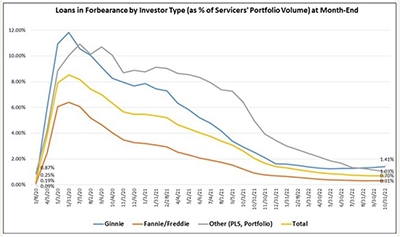

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of December 31, 2022.

Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in December

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of December 31, 2022.

Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in December

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of December 31, 2022.

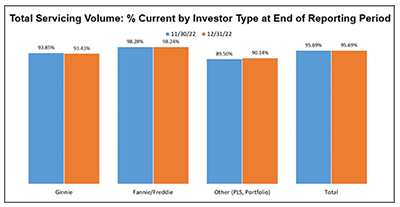

MBA: November Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance remained flat at 0.70% as of November 30. MBA estimates 350,000 homeowners are in forbearance plans.

MBA: November Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance remained flat at 0.70% as of November 30. MBA estimates 350,000 homeowners are in forbearance plans.

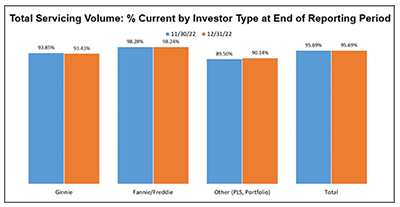

MBA: October Share of Mortgage Loans In Forbearance Up Slightly

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance increased by 1 basis point to 0.70% of servicers’ portfolio volume from 0.69% in the prior month as of October 31.

MBA: October Share of Mortgage Loans In Forbearance Up Slightly

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance increased by 1 basis point to 0.70% of servicers’ portfolio volume from 0.69% in the prior month as of October 31.

MBA Report: IMBs Report 3Q Losses

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $624 on each loan originated in the third quarter, the Mortgage Bankers Association reported Friday.