Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $2,812 on each loan they originated in the fourth quarter, the Mortgage Bankers Association reported Friday.

Tag: Marina Walsh CMB

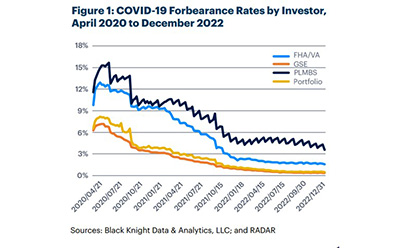

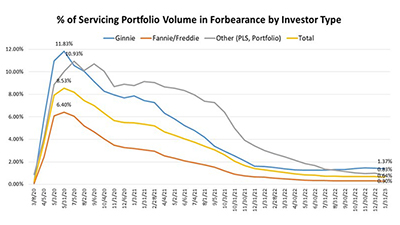

Philly Fed Report Declares Industry Victory on Forbearance

A report commissioned by the Federal Reserve Bank of Philadelphia found more than 95 percent of the estimated 8.5 million borrowers who entered forbearance have exited.

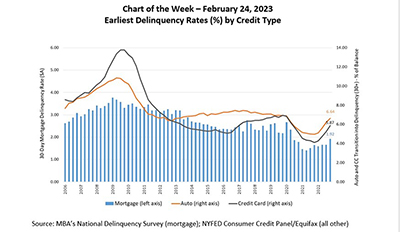

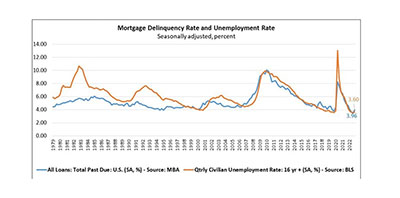

MBA Chart of the Week Feb. 24 2023–Delinquency Rates by Credit Type

The latest credit delinquency data from both MBA and other sources indicates that delinquencies are rising. In MBA’s National Delinquency Survey, covering national and state delinquencies through the fourth quarter of 2022 revealed that the delinquency rate for mortgage loans on one‐to‐four‐unit residential properties rose to a seasonally adjusted rate of 4.96 percent of all loans outstanding at the end of the fourth quarter.

MBA Chart of the Week Feb. 24 2023–Delinquency Rates by Credit Type

The latest credit delinquency data from both MBA and other sources indicates that delinquencies are rising. In MBA’s National Delinquency Survey, covering national and state delinquencies through the fourth quarter of 2022 revealed that the delinquency rate for mortgage loans on one‐to‐four‐unit residential properties rose to a seasonally adjusted rate of 4.96 percent of all loans outstanding at the end of the fourth quarter.

(#MBAServicing23) Market Outlook: A Few Hurdles Ahead

ORLANDO—The mortgage servicing industry has seen a lot of volatility lately—and that’s not likely to ease up any time soon, said Mortgage Bankers Association economists.

(#MBAServicing23) Market Outlook: A Few Hurdles Ahead

ORLANDO—The mortgage servicing industry has seen a lot of volatility lately—and that’s not likely to ease up any time soon, said Mortgage Bankers Association economists.

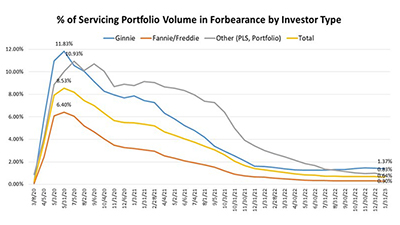

MBA: January Share of Mortgage Loans in Forbearance Decreases to 0.64%

Loans in forbearance decreased by 6 basis points in January to 0.64% of servicers’ portfolio volume as of January 31, the Mortgage Bankers Association reported Tuesday.

MBA: January Share of Mortgage Loans in Forbearance Decreases to 0.64%

Loans in forbearance decreased by 6 basis points in January to 0.64% of servicers’ portfolio volume as of January 31, the Mortgage Bankers Association reported Tuesday.

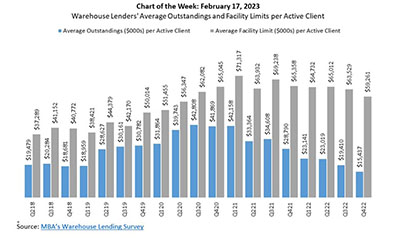

MBA Chart of the Week Feb. 17, 2023: Warehouse Lending

According to MBA’s latest Warehouse Lending Survey, warehouse lenders – as of the end of fourth-quarter 2022 – reported an average outstanding balance of $15.4 million per active client on their warehouse lines for first mortgages held for sale. This marks the fifth consecutive quarterly decline in per-client outstandings

MBA: 4Q Mortgage Delinquencies Increase

Mortgage delinquencies rose to near 4 percent in the fourth quarter, the Mortgage Bankers Association reported Thursday, but remained near survey lows.