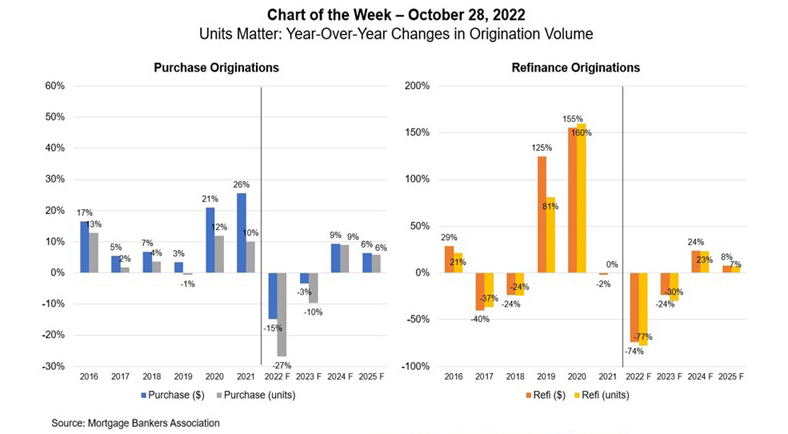

MBA Chart of the Week Oct. 28 2022: Year-Over-Year Changes in Origination Volume

Last week, MBA Research & Economics released its latest economic and mortgage market forecast at the MBA Annual Convention in Nashville. Based on our October forecast, total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from an estimated $2.26 trillion in 2022.

An economic recession, tighter financial conditions and lack of housing affordability will keep purchase activity sidelined, while mortgage rates – at the highest levels since 2001, and significantly higher than in 2020 and 2021 have shut off most refinance incentive. Purchase originations are forecast to decrease 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

This week’s MBA Chart of the Week examines year-over-year changes in origination volume ($ and units) dating back to 2016, and the forecasted volume from 2022 to 2025. In 2022, we expect a 15% decline in purchase origination dollars from 2021 but a steeper 27% decrease in the number of loans, as the number of purchase loans drops to under 4 million loans in 2022 from 5.4 million loans in 2021. In 2023, we expect a 3% decrease in dollars, but a 10% decrease in units, with the number of loans declining from 4 million in 2022 to a little over 3.5 million loans in 2023.

There have been larger differentials in the percent changes for dollar volume vs. units in the purchase market starting in 2020 because of the rapid rise in home prices that pushed average loan sizes much higher. We expect that gap to narrow as home price appreciation moderates in the coming years, with approximately flat price growth in 2023 and 2024. With refinance originations, the dollar volume vs. unit differential has been less apparent, with the exception of 2019 – a year when jumbo refinances surged.

The delineation between dollars and units is of importance when it comes to industry capacity and operational costs. In 2020 and 2021, mortgage lenders increased their capacity to originate around 14 million units per year between purchase and refinance loans. We expect to finish 2022 with only 6 million originations and a further drop to 5 million.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org; Marina Walsh, CMB mwalsh@mba.org.