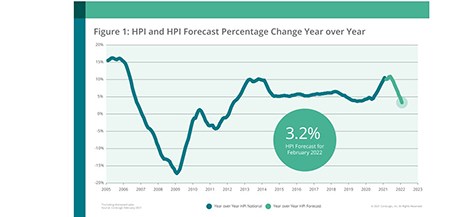

CoreLogic, Irvine, Calif., reported its monthly Home Price index recorded an 11.3% annual gain in March, the highest rate since March 2006.

Tag: Frank Martell

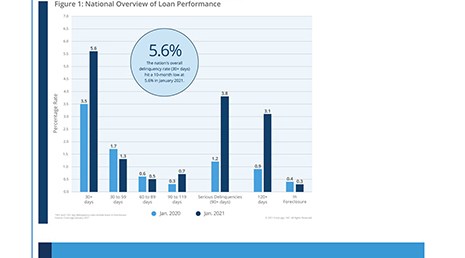

CoreLogic: Annual Mortgage Delinquency Rate Drops for 5th Straight Month to 10-Month Low

CoreLogic, Irvine, Calif., said while mortgage delinquencies rose month over month in January, overall delinquency rates fell for the fifth straight month to the lowest level since last March.

CoreLogic Home Price Index Reaches 15-Year High

CoreLogic, Irvine, Calif., said supply constraints and buyer demand pushed its monthly Home Price Index to a 15-year high in February.

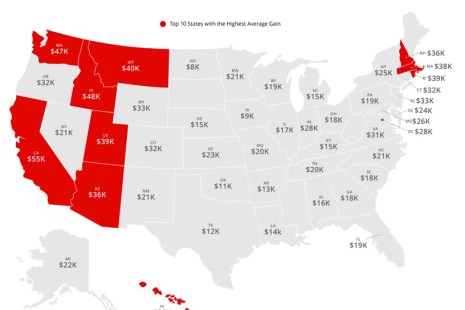

Home Equity Continues to Soar: Homeowners Gained $1.5 Trillion in 2020

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 16.2% year over year, representing a collective equity gain of more than $1.5 trillion, and an average gain of $26,300 per homeowner, from a year ago.

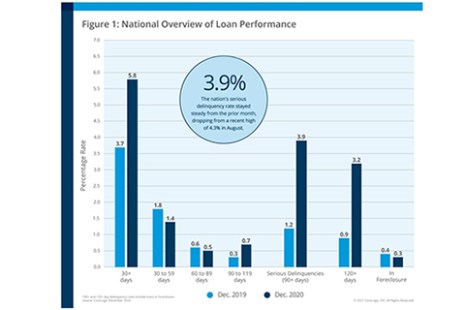

2020 Mortgage Delinquencies See Record Highs—and Record Lows

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

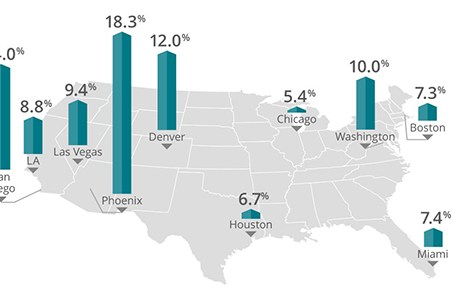

‘In High Gear:’ Annual U.S. Home Price Appreciation Reaches Double Digits

Add the CoreLogic Home Price Index to the growing Double-Digit Price Growth Club. The company’s monthly index showed nationally, home prices increased by 10 percent annually in January.

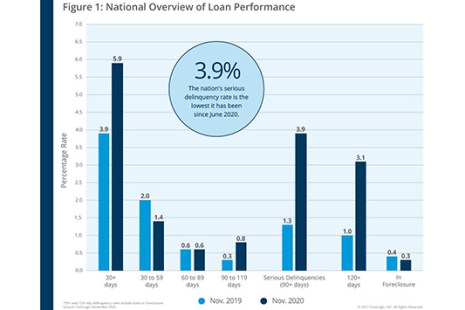

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

Ahead of this Thursday’s 4th Quarter National Delinquency Report from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

No Let-Up: 2020 Home Price Appreciation Outpaces 2019 by 50%

The U.S. housing market exceeded expectations in 2020, pricewise, said CoreLogic, Irvine, Calif., closing out the year with the highest annual home price gain—9.2%—since February 2014.

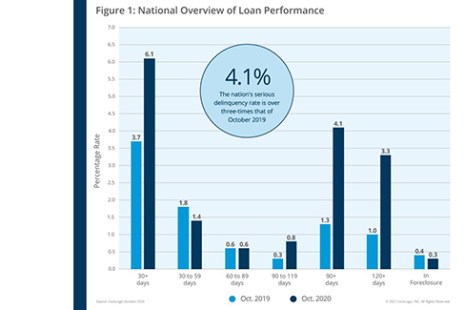

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

No Letup in Home Price Gains; CoreLogic Reports 8.2% Annual Growth

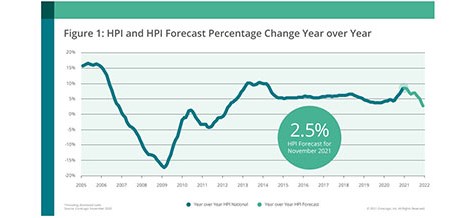

CoreLogic, Irvine, Calif., said its November U.S. Home Price Index saw its largest annual appreciation since March 2014. The report said nationally, home prices increased by 8.2% in November from a year ago. On a month-over-month basis, home prices increased by 1.1% from October.