CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

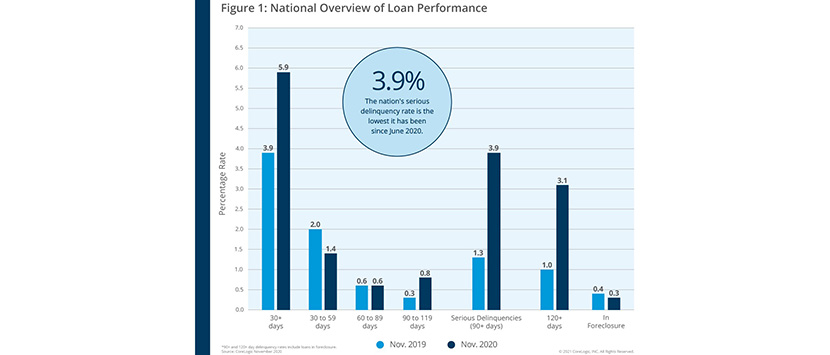

(Chart courtesy of CoreLogic, Irvine, Calif.)

CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

The company’s monthly Loan Performance Insights Report for November said on a national level, 5.9% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), 2-percentage point increase in the overall delinquency rate from a year ago, when it was 3.9%. This is the lowest overall delinquency rate since an initial jump in April.

Other report findings:

• Early-Stage Delinquencies (30 to 59 days past due): 1.4%, down from 2% a year ago.

• Adverse Delinquency (60 to 89 days past due): 0.6%, unchanged from a year ago.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.9%, up from 1.3% a year ago, the lowest serious delinquency rate since June, pointing to signs of increasing stabilization.

• Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% in a year ago.

• Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, down from 1% a year ago.

CoreLogic Chief Economist Frank Nothaft said the 2020 recession has had a disparate impact on households, with those in oil and hospitality industries especially hard hit. However, the recent rebound in employment has helped some struggling homeowners begin to make payments again.

“Urban areas hit hard by the pandemic recession or by a natural disaster experienced the largest spike in delinquency over the last year,” Nothaft said. “Forbearance and loan modification helped struggling families rebuild their financial house in hard-hit places. While vaccination will mitigate the pandemic, the best cure for delinquency is income restoration through job creation.”

“The consistent decline in serious delinquency since August is a sign of growing financial stability for families,” said Frank Martell, president and CEO of CoreLogic. “In addition to ensuring that homeowners stay in their homes, the decline in delinquency means fewer distressed sales, which is both a positive for individual households and the overall housing market.”

The report said every state logged an annual increase in overall delinquency rates in November. Hawaii (up 4.3 percentage points) and Nevada (up 4.2 percentage points) topped the list for gains.

Nearly every U.S. metro area logged an increase in overall delinquency rates in November from a year ago. Odessa, Texas, experienced the largest annual increase with 9.5 percentage points, likely due to significant job loss in the oil industry. Other metro areas with significant increases included Lake Charles, La. (up 9.1 percentage points); Midland, Texas (up 7.4 percentage points) and Kahului, Hawaii (up 7.2 percentage points).