CoreLogic Home Price Index Reaches 15-Year High

CoreLogic, Irvine, Calif., said supply constraints and buyer demand pushed its monthly Home Price Index to a 15-year high in February.

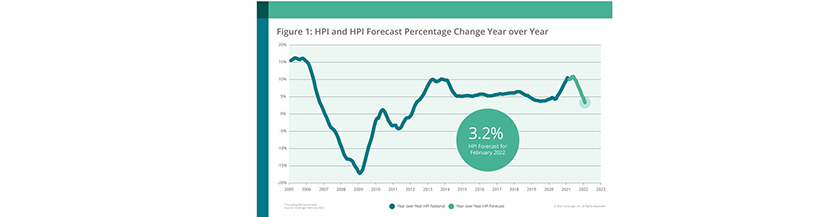

The HPI recorded highest annual growth since 2006 in February at 10.4%, as demand continued to clash with historically low supply. These factors have created increased affordability challenges, especially as mortgage rates also begin to rise.

The report also noted homebuyers have steadily moved away from densely populated, high-cost coastal areas in favor of more affordable suburban locales. The number of homebuyers in the top 10 metros with the largest net out-migration — including West Coast metros such as Los Angeles, San Francisco and San Jose — who chose to move to another metro increased by 3 percentage points in 2020 to 21% from 2019. This sentiment is reflected in CoreLogic’s recent consumer survey, which found 57% of current non-homeowners on the West Coast feel the home options in their area are not at all affordable.

“Homebuyers are experiencing the most competitive housing market we’ve seen since the Great Recession,” said Frank Martell, president and CEO of CoreLogic. “Rising mortgage rates and severe supply constraints are pushing already-overheated home prices out of reach for some prospective buyers, especially in more expensive metro areas. As affordability challenges persist, we may see more potential homebuyers priced out of the market and a possible slowing of price growth on the horizon.”

Other report findings:

• Nationally, home prices increased 10.4% in February from a year ago. On a month-over-month basis, home prices increased by 1.2% from January.

• Home prices are projected to increase 3.2% by February 2022. Increased inventory as the pandemic wanes, coupled with affordability concerns that may discourage potential homebuyers, could lead to a slowdown in home price growth by the end of 2021.

• Metro areas where affordability constraints are prevalent continue to persist as prices rise. For instance, in February, home prices increased 16.2% year over year in Phoenix, 12.5% in Seattle and 8.2% in Los Angeles.

• At the state level, Idaho, Montana and South Dakota had the strongest price growth in February, up 22.6%, 19.5% and 17.1%, respectively.

“The run-up in home prices is good news for current homeowners but sobering for prospective buyers,” said Frank Nothaft, chief economist at CoreLogic. “Those looking to buy need to save for a down payment, closing costs and cash reserves, all of which are much higher as home prices go up. Add to that a rise in mortgage rates and the affordability challenge for first-time buyers becomes even greater.”