The U.S. residential housing economy, which represents about 17% of GDP, will likely continue growing in second-half 2024 despite unaffordability due to high home prices and mortgage rates, according to Fitch Ratings, Chicago/New York.

Tag: Fitch Ratings

Offices, Insurance Top Commercial Servicing Conversations, Panel Says

NEW ORLEANS–Looking at servicing in the current commercial market, offices and insurance issues are top of mind. That’s per a panel at the Mortgage Bankers Association Commercial/Multifamily Finance Servicing and Technology Conference, here, May 20.

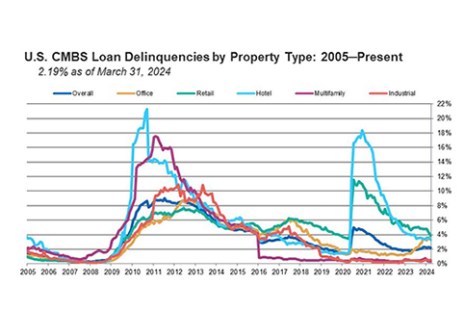

High Resolution Volume Drives CMBS Delinquency Rate Lower, Fitch Reports

The U.S. commercial mortgage-backed securities delinquency rate decreased nine basis points to 2.19% in March, according to Fitch Ratings, New York.

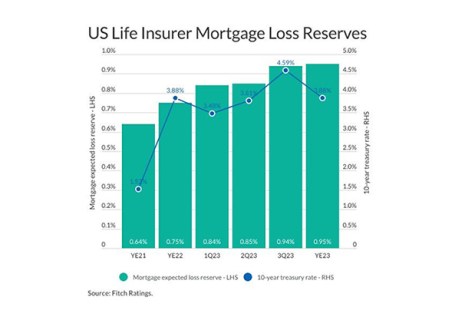

Fitch: Life Insurers CRE Risks Grow; Remain Within Ratings Expectations

Fitch Ratings, New York, said the U.S. life insurance sector has “material exposure” to commercial real estate, but noted insurer ratings are unlikely to move due to potential CRE losses.

Fed Holds Rates Steady; Signals Cut Later

The Federal Reserve’s Federal Open Market Committee held rates unchanged at its March meeting and continued to signal its next move will be a rate cut.

Fitch Ratings: Mortgage Insurer Ratings Reflect Strong Borrower Credit Performance

Fitch Ratings, New York, said underwriting results for U.S. mortgage insurers remained very strong through 2023.

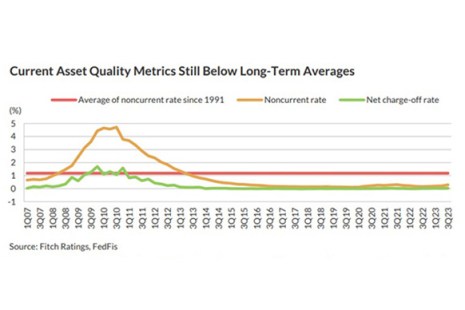

Bank Multifamily Asset Quality to Deteriorate Amid Higher Refi Rates: Fitch

Fitch Ratings, New York, said it expects banks’ asset-quality metrics to deteriorate for certain U.S. multifamily loans as borrowers will face elevated risks from higher refinancing rates and valuation pressures as loans mature over the next few years.

Fitch Says Weaker Collateral for Non-QM/Non-Prime 2023 RMBS Leads to Elevated Delinquency Rate

Fitch Ratings, New York, said delinquencies for non-QM 2023-vintage RMBS transactions are higher than the 2022 vintage, reflection weaker collateral attributes.

Fitch: Outlook for Equity REITs is Deteriorating

Fitch Ratings, New York, said the outlook for U.S. equity real estate investment trusts in 2024 is deteriorating.

Fitch: Weaker Demand but Normalizing Dynamics for Building Products in 2024

Fitch Ratings, New York, reported it expects overall weaker demand for North American building products and materials companies in 2024.