Fitch: Life Insurers CRE Risks Grow; Remain Within Ratings Expectations

(Illustration courtesy of Fitch Ratings)

Fitch Ratings, New York, said the U.S. life insurance sector has “material exposure” to commercial real estate, but noted insurer ratings are unlikely to move due to potential CRE losses.

“[U.S. life insurance company] portfolios are largely comprised of high-quality loans and lower-risk pieces of commercial real estate exposures, with 90% of commercial mortgage loans rated CM1 or CM2 on a NAIC basis,” Fitch said in a non-rating commentary.

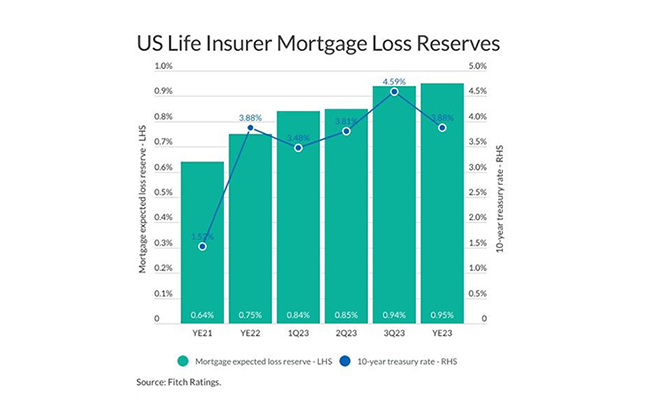

Fitch said higher interest rates and the scale of U.S. office re-pricing add significant refinancing risk for 10-year fixed-rate loans, the mainstay of the CRE loan market where life insurance companies and U.S. conduit CMBS are active players. “However, rising rates have been largely favorable for U.S. life insurer investment portfolios, driving higher investment income as reinvestment rates exceed book yields, though the higher rates unfavorably affect bonds’ market values and CRE valuations,” the report said.

The proportion of nonperforming loans was minimal for life insurers as of year-end. “However, CRE, especially office-related exposure, will remain challenged by both higher cap rates and lower occupancy rates post-pandemic,” the report said. “CRE losses are expected to emerge for the industry over multiple periods, but portfolios are expected to maintain material equity cushions despite rising losses. The vast majority of 2023 maturities were paid off or extended, with realized losses expected to remain low in 2024.”

U.S. life insurance portfolios maintain “comfortable” equity cushions, Fitch said. “However, for the 10 companies with disclosures, the average loan-to value [ratio] increased two percentage points year-over-year to 57% as of year-end 2023. LTVs should continue to rise in this higher interest rate environment, particularly for more troubled property types,” the report said.