Bank Multifamily Asset Quality to Deteriorate Amid Higher Refi Rates: Fitch

(Illustration courtesy of Fitch; Image courtesy of Ana Luisa/pexels.com)

Fitch Ratings, New York, said it expects banks’ asset-quality metrics to deteriorate for certain U.S. multifamily loans as borrowers will face elevated risks from higher refinancing rates and valuation pressures as loans mature over the next few years.

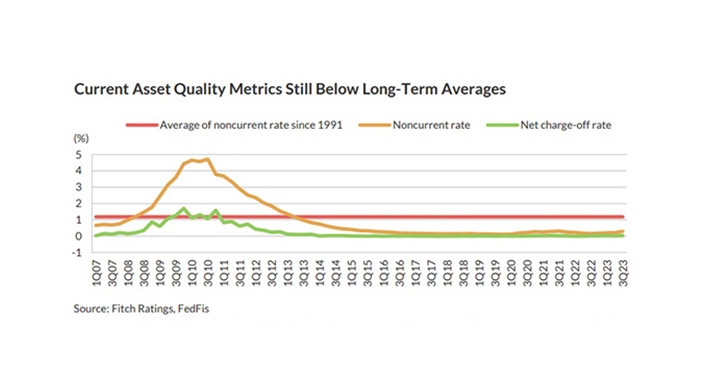

But the level of multifamily loans past due or on non-accruing status remain below long-term averages and well below the peak levels U.S. banks saw during the 2008 Global Financial Crisis, Fitch said in a new report, U.S. Banks with Maturing Multifamily Loans Face Refinancing Risks. (subscription)

“Multifamily loans facing pressure include those that are rent stabilized, reliant on overly optimistic rental income increase projections or in submarkets with elevated rental vacancy rates and/or excess supply, many of which are in Sunbelt states, particularly Texas, Florida, Tennessee and the Carolinas,” the report said. It noted multifamily lending by banks has grown 32% since the start of the pandemic to $613 billion outstanding as of the fourth quarter, driven by low interest rates, high levels of housing demand and attractive rents. The ten largest multifamily lenders in dollar terms comprise nearly 40% of total multifamily loans for U.S. banks, Fitch said.

Fitch found 49 banks as of year-end 2023 with multifamily non-performing loans greater than 5% of their total multifamily loans. It noted these banks are relatively small, averaging $1.3 billion in total assets.

“While nonperforming loans are elevated for this subset of community banks, the balance of multifamily loans at these banks is only a modest fraction of the overall industry, thereby limiting the contagion to the broader financial system if one or more of these banks were to fail,” the report said. “We expect any deterioration to play out for the banking sector over an extended period. During the Global Financial Crisis, losses did not peak until almost two years after a peak in delinquencies, and problem loans have yet to peak for the sector.”