Fitch: 2024 Outlook for Mortgage Insurers Revised to Neutral

(Image via Fitch)

Fitch Ratings, New York, has revised its 2024 sector outlook for U.S. mortgage insurers to neutral. Previously the outlook had it at deteriorating.

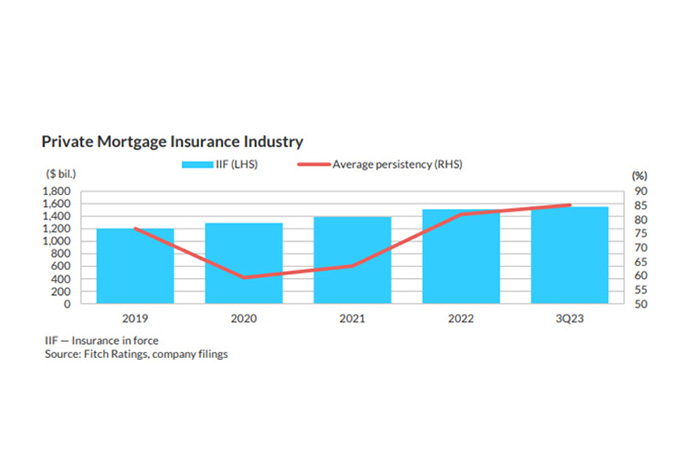

The sector outlook reflects resilience in the economy, predicting a modest increase in unemployment and potential pricing corrections in housing, offset by stable insurance in force driven by increased persistency.

Mortgage insurers will be able to remain stable even with a mild recession next year, Fitch said. Pricing increases were driven by uncertainty and the desire to be conservative, and Fitch posited MI management teams have moderated expectations for near-term economic stress.

“We expect unemployment to rise modestly next year, which will likely lead to an equivalent rise in borrower defaults,” said Senior Director Chris Grimes. “However, strong borrower credit characteristics and favorable home equity build-up for the majority of homeowners should moderate the frequency and severity of ultimate mortgage insurance claims.”

In terms of trends Fitch predicted over the next year, it posited that interest rate-driven persistency will offset lower originations, as refinancing remains unlikely for homeowners with low interest rates. A resilient housing market, with continued strong pricing, will also help moderate loss activity.

Additionally, MI companies will continue to pursue a conservative approach to risk management, Fitch said. Capital market reinsurance capacity will continue to provide risk transfer diversity as more MI companies turn back to mortgage insurance-linked notes after some variation in that space over the past few years.