Fitch Shifts Its Outlook for U.S. Title Insurers to Neutral in 2024

(Illustration courtesy of Fitch Ratings)

Fitch Ratings, New York, shifted its sector outlook for the U.S. title insurance market to neutral for 2024.

“Underpinning the neutral outlook is Fitch’s view that mortgage interest rates are near peak levels, and title insurance industry profits will expand modestly from 2023 levels, tied to revenue and expense ratio improvement,” Fitch said in its U.S. Title Insurance Outlook 2024 report.

“Profitability within the U.S. title insurance sector is fundamentally linked to activity in the U.S. residential housing and mortgage markets, which experienced material economic headwinds over the last 18 months that are expected to continue, albeit to a lesser degree, into first-half 2024,” Fitch said. “The sector outlook considers the economic fundamentals expected in 2024 relative to those present in 2023, and reflect the expectation that key housing market activity in 2024 will be in line with 2023.”

The report noted several factors that could lead to financial performance below expectations, including mortgage rates substantially increasing, tighter credit market conditions and a more severe recession in 2024 than originally forecast that could lead to significantly higher unemployment levels.

“Commercial property transactions materially influence large underwriters’ revenue and financial performance, comprising 10% of title revenues,” the report said. “Office and retail property types are likely to still experience pressure in 2024, while multifamily and industrial property types are anticipated to remain robust over the next year. In aggregate, overall commercial volumes are expected to be modestly down in 2024.”

Fitch called the U.S. title insurance market “concentrated,” with just four national underwriters accounting for approximately 82% of total industry premiums as of the first three quarters of 2023. This group includes Fidelity National Financial, Inc.; First American Financial Corp.; Stewart Information Services Corp.; and Old Republic International Corp. which Fitch does not rate.

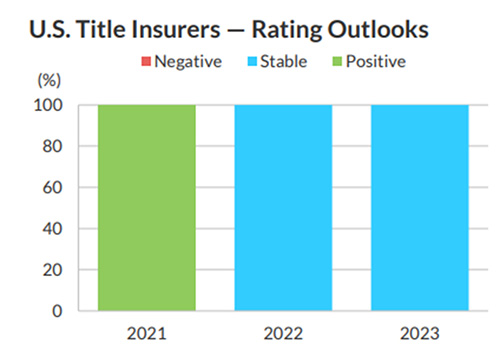

“The stable rating outlooks for Fitch’s rated title universe is predicated on very strong capital positions that can absorb near-term declines in operating performance, along with a resiliency in operating margins, albeit at lower levels from the highs of prior years,” Fitch said. Gerald Glombicki, Senior Director with Fitch, said the firm thinks mortgage rates are near peak levels at the moment and noted rates could potentially decline in 2024, “which will cause mortgage originations to stabilize,” he said. “A shift in the sector outlook is a result of a benign claims environment and strong capital levels, combined with a leaner expense structure.”