SAN DIEGO–MBA President and CEO Bob Broeksmit, CMB, highlighted challenges to the commercial real estate finance industry–from Basel III to affordability–here at the MBA Commercial/Multifamily Finance Convention and Expo.

Tag: FHA

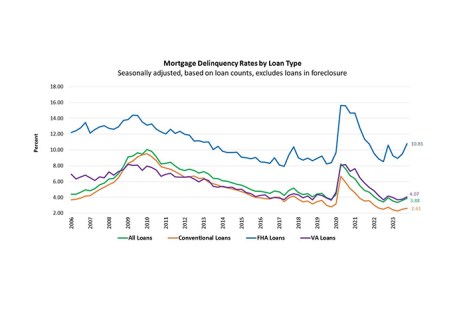

MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

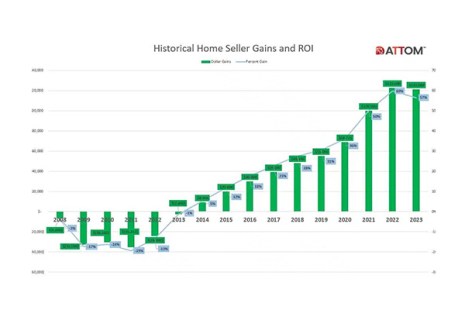

ATTOM: 2023 Home Selling Profits Still High, but Drop for First Time Since 2011

ATTOM, Irvine, Calif., released its Year-End 2023 U.S. Home Sales Report, highlighting that home sellers garnered $121,000 in profit on a typical home, and a 56.5% return on investment, in 2023.

HUD Secretary Fudge Willing to Examine Dropping Life-of-Loan FHA Coverage

At a House Financial Services Committee hearing Thursday, HUD Secretary Marcia Fudge suggested the agency would consider eliminating life-of-loan premium requirements for FHA-backed mortgages.

MBA Statement on FHA’s Annual Report to Congress

Bob Broeksmit, CMB, President and CEO of the Mortgage Bankers Association, issued the following statement regarding the Federal Housing Administration’s release of its annual report to Congress:

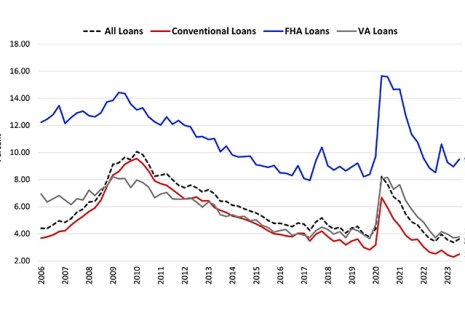

MBA Chart of the Week: Delinquency Rates by Loan Type, Conventional, FHA, VA

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62% of all loans outstanding at the end of the third quarter of 2023.

Industry Briefs Nov. 8, 2023

Industry news from FHA, CoreLogic, LenderLogix, Down Payment Resource, Ncontracts, findCRA and FormFree.

Industry Briefs Nov. 7, 2023

Industry news from FHA, CoreLogic, LenderLogix, Down Payment Resource, Ncontracts, findCRA and FormFree.

MBA NewsLink Q&A: Donna Schmidt of DLS Servicing on the FHA Loss Mitigation Waterfall

MBA NewsLink spoke with DLS Servicing’s Donna Schmidt on the FHA loss mitigation waterfall.

Officials Provide Updates on Repurchases, ADUs, Outlooks at MBA Annual

PHILADELPHIA–A slate of federal officials took to the stage to provide updates at the Mortgage Bankers Association’s Annual Convention & Expo here Oct. 16.