ATTOM: 2023 Home Selling Profits Still High, but Drop for First Time Since 2011

(Image courtesy of ATTOM)

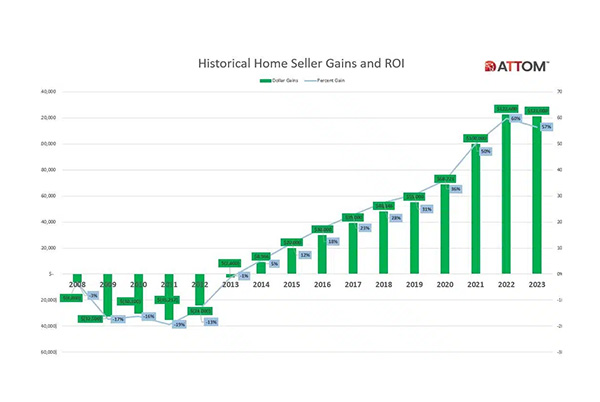

ATTOM, Irvine, Calif., released its Year-End 2023 U.S. Home Sales Report, highlighting that home sellers garnered $121,000 in profit on a typical home, and a 56.5% return on investment, in 2023.

While those numbers remain near record highs, they are a decrease from 2022, marking the first decline since 2011. In 2022, the gross profit on a median-priced single-family home sold was $122,600, with sellers making a 59.8% return on investment.

“Last year certainly stood out as another very good year for home sellers across most of the United States. Typical profits of over $120,000 and margins close to 60% were still more than double where they stood just five years earlier,” said Rob Barber, CEO at ATTOM. “But the market definitely softened amid modest price gains that weren’t enough to push profits up higher after a long run of improvements. In 2024, the stage seems set for more small changes in prices as well as seller gains given the competing forces of interest rates that have headed back down in recent months and home supplies that remain tight, but home ownership costs that remain a serious financial burden for many households.”

The national median home price also recorded the slowest pace of growth since 2011, at 2.1%. That did push the price to yet another all-time annual high of $335,000.

Homeownership tenure by sellers who sold in the fourth quarter of 2023 hit 7.96 years, up from 7.8 years in the third quarter. That’s the highest tenure since 2021.

Cash sales were at the highest point in 2023 since 2014. They accounted for 38% last year, although remain below the most recent 44.7% peak in 2011.

Lender-owned foreclosures were up slightly, at 1.5% from 1.2% in 2022, but still at one of the lowest levels since 2005.

Institutional investing was down, with 6.1% of all single-family home and condo sales in 2023–it stood at 7.6% in 2022.

FHA sales were 8.8% of purchases of single-family homes and condos, up from 7.5% in 2022.