MBA Chart of the Week: Delinquency Rates by Loan Type, Conventional, FHA, VA

Source: MBA’s National Delinquency Survey

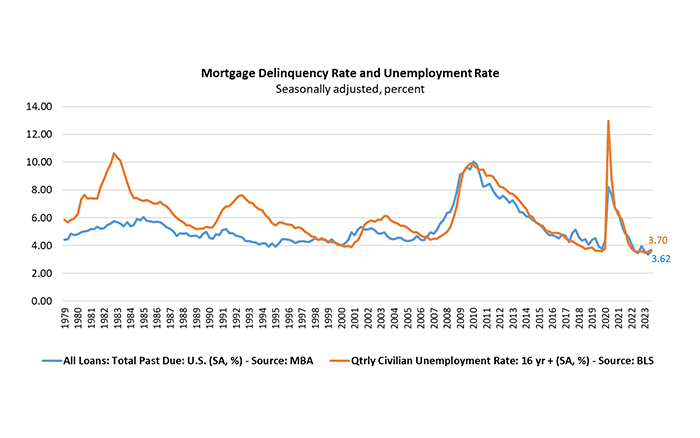

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62% of all loans outstanding at the end of the third quarter of 2023.

The delinquency rate was 25 basis points higher than the series-low 3.37% reached in the second quarter of this year.

The mortgage delinquency increase occurred across all loan types – conventional, FHA, and VA – with the largest increase attributed to FHA loans. The delinquency rate for conventional loans increased 21 basis points to 2.5% over the previous quarter. The FHA delinquency rate increased 55 basis points to 9.5%, and the VA delinquency rate increased by 6 basis points to 3.76% over the previous quarter.

The uptick in delinquencies was driven entirely by an increase in earliest-stage delinquencies – those 30-days and 60-days past due. Later-stage delinquencies – those 90 days or more past due – declined in the third quarter of 2023 across all loan types. At the same time, the percentage of loans in the foreclosure process also dropped from the previous quarter across all loan types. These factors suggest that distressed homeowners may have loss mitigation options available to them. In addition, accumulated home equity may enable homeowners to sell their homes well before foreclosure becomes a possibility.

Anh Doan (adoan@mba.org); Marina Walsh (mwalsh@mba.org)