MBA’s President and CEO Bob Broeksmit, CMB, released a series of statements.

Tag: FHA

Today: FHA Credit Watch Program–Overview and Remediation

On Oct. 1, don’t miss the opportunity to hear directly from seasoned experts and walk away with the insights you need to safeguard your organization’s FHA lending operations.

MBA Statement on HUD Proposal to Level FHA Multifamily Mortgage Insurance Premiums

MBA’s President and CEO Bob Broeksmit, CMB, released a statement regarding HUD’s proposal to level upfront and annual mortgage insurance premiums for its FHA Multifamily Accelerated Processing programs.

MBA Asks HUD to Update FHA Multifamily Accelerated Processing Program

MBA sent the Department of Housing and Urban Development a letter urging the agency to consider some recommended updates to its FHA Multifamily Accelerated Processing program to lower housing costs and boost housing supply.

MBA Statement on FHA’s Adoption of New Loss Mitigation Safeguards

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Federal Housing Administration’s (FHA) adoption of new loss mitigation safeguards.

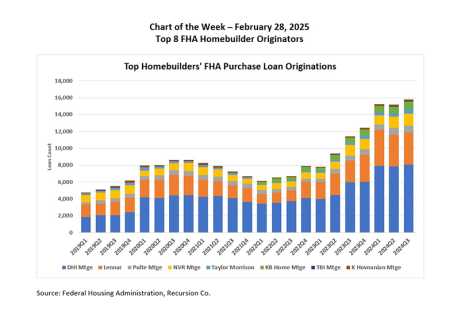

Chart of the Week: Top 8 FHA Homebuilder Originators

The headwinds facing mortgage transactions continued unabated in 2024 as home prices reached new record highs while the 30-year mortgage rate rose back over 7%. One sector that effectively dealt with these impediments was the homebuilders.

MBA, Other Groups Send FHA Letter on Loss Mitigation Update Recommendations

The Mortgage Bankers Association, along with a number of other trade groups, sent a letter to FHA on its November 2024 proposal on loss mitigation updates to its Servicing Handbook.

FHA Extends Foreclosure Moratoriums for Borrowers Affected by Hurricanes Helene, Milton

The Federal Housing Administration on Friday extended the foreclosure moratoriums in connection with Hurricanes Helene and Milton through April 11, 2025.

FHA Revises Cyber Incident Reporting Requirements

The Federal Housing Administration on Monday updated its requirements for cyber incident reporting.

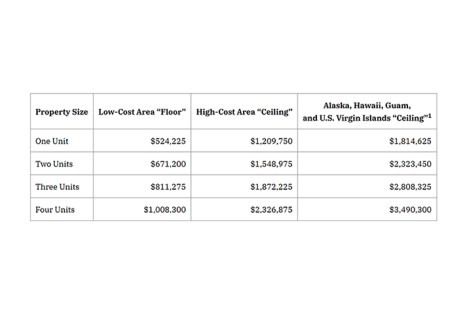

HUD Announces 2025 Loan Limits

The Federal Housing Administration on Tuesday announced new loan limits for calendar year 2025 for its Single-Family Title II forward and Home Equity Conversion Mortgage insurance programs.