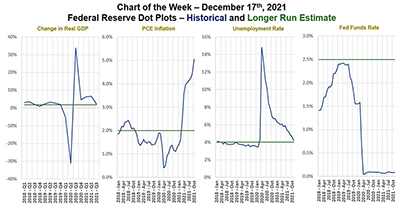

This week’s MBA Chart of the Week traces the Federal Open Market Committee forecasts and long-run estimates of four key metrics that contribute to Fed decision-making and communication – GDP, inflation, unemployment and the Fed funds rate.

Tag: Federal Open Market Committee

MBA Chart of the Week Dec. 17 2021: Federal Reserve Dot Plots

This week’s MBA Chart of the Week traces the Federal Open Market Committee forecasts and long-run estimates of four key metrics that contribute to Fed decision-making and communication – GDP, inflation, unemployment and the Fed funds rate.

Fed Moves Up Timetables

The Federal Open Market Committee on Wednesday said it would speed up its tapering of agency mortgage-backed securities and hinted its timetable for raising the federal funds rate could move up as well.

The Week Ahead Dec. 13, 2021: Four Things to Know

Good morning! It’s beginning to look a lot like the holidays—but we’ve still got a few weeks of business to take care of, first. Here are four things to look for this week:

Fed Makes Tapering Official; Signals Higher Rates in the Offing

The Federal Open Market Committee—which takes pains to not rock the economic boat—announced yesterday what most analysts already anticipated: that it would begin to taper its asset purchases, while gently signaling a rise in short-term interest rates in the near future.

FOMC Pushes Up Rate Hike Schedule

The Federal Reserve isn’t planning on raising key interest rates any time soon, but the trigger finger appears to be getting itchier.

The Week Ahead Sept. 20, 2021: Five Things to Watch

Good Monday morning! Welcome to the (official) Last Week of Summer and another busy week for the real estate finance industry. Here are five things to watch for this week:

Fed Sees Rising Economic Growth—and Inflation; Moves Up Rate Hike Timetable

The Federal Reserve isn’t raising interest rates anytime soon, but it did suggest Wednesday that the timetable for increases could begin sooner in 2023 if economic growth and inflation continue to rise faster than expected.

The Week Ahead—June 15, 2021

Good morning! While Congress continues to work out a compromise on infrastructure legislation, eyes shift to Foggy Bottom, where the Federal Open Market Committee meets this week to figure out if inflation has become a problem.

Fed Statement Cites Ongoing Risks to Growing Economy

The Federal Open Market Committee yesterday, to no one’s surprise, left the federal funds rate unchanged at 0-0.25%. But analysts, including Mortgage Bankers Association Chief Economist Mike Fratantoni, were more interested in what the FOMC had to say about economic conditions and rising inflation.