The Federal Open Market Committee meets this Tuesday, Mar. 21 and Wednesday, Mar. 22 amid remarkable conditions: persistent inflation, persistent job and wage growth, persistent economic volatility—and, as of last week, the collapse of two major financial institutions (Silicon Valley Bank and Signature Bank) and shaky conditions with at least two other institutions.

Tag: Federal Open Market Committee

Fed Raises Funds Rate 25 Basis Points

The Federal Open Market Committee telegraphed its intentions weeks ago; on Wednesday, to no one’s surprise, it raised the federal funds rate by 25 basis points.

Fed Slows Pace of Rate Hikes, But Hints at More

In its final policy meeting of an eventful year, the Federal Open Market Committee on Wednesday raised the federal funds rate for the seventh straight meeting, but by 50 basis points instead of 75 basis points, as it had for the past four times.

Fed Slows Pace of Rate Hikes, But Hints at More

In its final policy meeting of an eventful year, the Federal Open Market Committee on Wednesday raised the federal funds rate for the seventh straight meeting, but by 50 basis points instead of 75 basis points, as it had for the past four times.

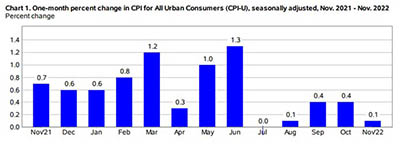

November CPI Posts Welcome ‘Modest’ Increase

It’s not often that “modest” has economic significance, but when it refers to inflation as of late, then “modest” is perhaps a welcome description.

The Week Ahead, Dec. 12, 2022: The Fed and Five Other Things to Know

Good morning, and happy Monday! The holidays are coming up quickly, and a lot has to happen before then. Here’s what you need to know this week:

Fed Raises Rate to 15-Year High

The Federal Open Market Committee, as expected, raised the federal funds rate by 75 basis points on Wednesday to its highest level since 2008.

Ramp it Up: Fed Hikes Rates by 75bps for 3rd Straight Meeting

The Federal Open Market Committee raised the federal funds rate by another 75 basis points Wednesday to 3-3.25 percent, the third consecutive such increase and the fifth increase since March.

The Week Ahead, Sept. 19, 2022: The Fed, Housing Reports and What You Need to Know

Good morning and happy Monday! Time to gear up for a busy, busy week. Here’s what’s happening:

FOMC Raises Federal Funds Rate 75 Basis Points

The Federal Open Market Committee hiked the federal funds rate by 75 basis points on Wednesday, matching its 75 basis point increase in June.