Good morning and happy Monday! Here at MBA we are excited that the autumn edition MBA LIVE, the association’s virtual conference series, continues this week with the MBA Risk Management QA & Fraud Prevention Forum takes place online this Tuesday, Sept. 15 and Wednesday, Sept. 16.

Tag: Federal Open Market Committee

Fed: No Change in Policy Anytime Soon

The Federal Open Market Committee yesterday said ongoing concerns about the coronavirus and the resulting economic stall means it will hold fast on its current policies.

The Week Ahead

The Federal Open Market Committee holds its next Policy Meeting this Tuesday, July 28 and Wednesday, July 29. While Fed-watchers don’t expect the FOMC to take action on the federal funds rate—it’s already at zero—they will, as usual, go over the Wednesday statement with a fine-toothed editing pencil to gain insight on other steps to boost an uncertain economy amid the global coronavirus pandemic.

Fed: No Rate Hike Until ‘at Least 2022’

The Federal Open Market Committee yesterday offered cautious hope for an economic turnaround following the body-slam brought on by the coronavirus pandemic. But it soberly noted the economic recovery could take some time.

Fed Says ‘Full Range of Tools’ Will Support Economy During ‘Challenging Time’

The Federal Open Market Committee yesterday said it is committed to using its “full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.”

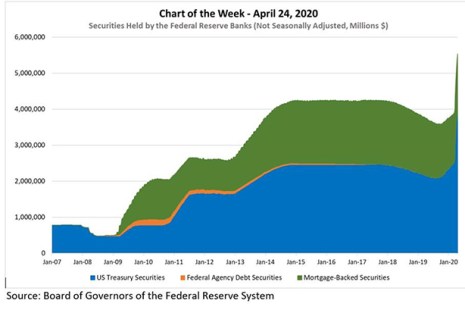

MBA Chart of the Week: Securities Held by Federal Reserve Banks

The MBA Chart of the Week shows the evolution of securities held outright by the Federal Reserve Banks since 2007.

The Week Ahead

Good morning! Welcome to another Monday, Week 8 of the Coronapacolypse.

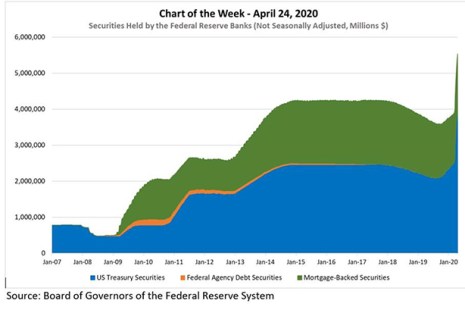

MBA Chart of the Week: Securities Held by Federal Reserve Banks

The MBA Chart of the Week shows the evolution of securities held outright by the Federal Reserve Banks since 2007.

MBA Raises Concerns with SEC on Broker-Dealer Margin Call Volatility

The Mortgage Bankers Association, in a letter Sunday to the Securities and Exchange Commission and the Financial Industry Regulatory Authority, raised “urgent concern” about dramatic price volatility in the market for agency mortgage-backed securities over the past week that leading to broker-dealer margin calls on mortgage lenders’ hedge positions that are unsustainable for many such lenders.

Fed Bolsters Efforts to Stem Economic Impact of Coronavirus

The Federal Reserve, in its most aggressive actions to date, announced further steps yesterday to mitigate the economic impact of the coronavirus pandemic, including actions strongly advocated for over the weekend by the Mortgage Bankers Association.