The Federal Housing Finance Agency published a final rule that requires Fannie Mae and Freddie Mac to provide advance notice to FHFA of new activities and obtain prior approval before launching new products.

Tag: Federal Housing Finance Agency

FHFA Issues 2023-2024 GSE Multifamily Housing Goals

The Federal Housing Finance Agency on Wednesday issued its final rule for Fannie Mae and Freddie Mac that establishes the benchmark levels for their 2023 and 2024 multifamily housing goals.

Industry Briefs Dec. 14, 2022: CFPB Proposes Registry to Detect ‘Repeat Offenders’

The Consumer Financial Protection Bureau proposed requiring certain nonbank financial firms to register with the CFPB when they become subject to certain local, state or federal consumer financial protection agency or court orders.

MBA Offers FHFA Recommendations on Housing Equity

The Mortgage Bankers Association, in a letter to the Federal Housing Finance Agency, offered a set of recommendations addressing the Agency’s efforts to improve home equity, particularly with respect to the racial homeownership gap.

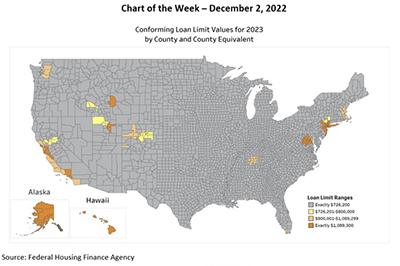

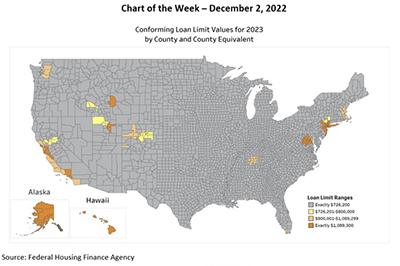

MBA Chart of the Week Dec. 2, 2022: GSE Conforming Loan Limits

Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

MBA Chart of the Week Dec. 2, 2022: GSE Conforming Loan Limits

Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

FHFA Raises 2023 GSE Conforming Loan Limits to $726,000

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.

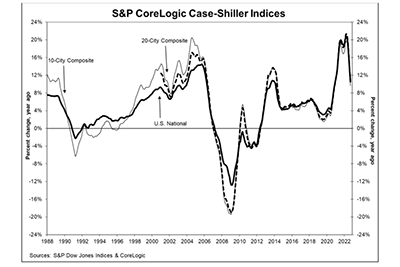

House Prices Continue to Flatten

Reports from S&P Down Jones Indices, New York, and the Federal Housing Finance Agency show continued flattening of home prices nationwide, although they remain elevated in most markets.

FHFA Raises 2023 GSE Conforming Loan Limits to $726,000

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.