In the first quarter of 2025, U.S. house prices increased 4% compared to the first quarter of 2024, as reported by the Federal Housing Finance Agency.

Tag: Federal Housing Finance Agency

FHFA Reports More Than 7 Million Foreclosure Prevention Actions During GSE Conservatorships

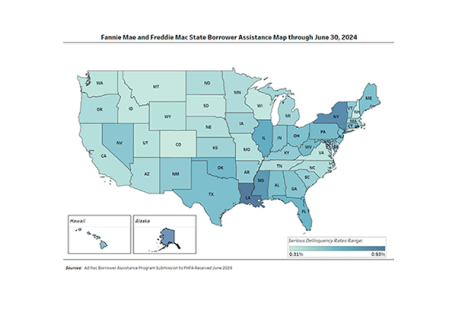

The Federal Housing Finance Agency reported that Fannie Mae and Freddie Mac completed 46,378 foreclosure prevention actions during the second quarter, raising the total number of homeowners who have been helped to 7,004,262 since the start of conservatorships in September 2008.

MBA’s Bob Broeksmit on Recent Trigger Leads Progress, Other Key Industry Issues to Watch

WASHINGTON, D.C.–Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, took the stage at MBA’s Compliance and Risk Management Conference Sept. 23 to discuss some hot topics–including the recent addition of trigger leads provisions in the National Defense Authorization Act.

Fannie Mae, Freddie Mac Announce New Protections for Renters

Fannie Mae and Freddie Mac announced new protections for renters in multifamily properties with mortgages backed by the enterprises.

MBA Weighs in with FHFA on FHLB Core Mission Activities

The Mortgage Bankers Association submitted a letter yesterday to the Federal Housing Finance Agency regarding its request for information on Federal Home Loan Bank core mission activities.

FHFA Releases NMDB Outstanding Residential Mortgage Statistics

There were 50.8 million outstanding mortgages with unpaid balances totaling $11.7 trillion at the end of the first quarter, the Federal Housing Finance Agency reported Tuesday.

FHFA Announces Members of Federal Advisory Committee on Affordable, Equitable and Sustainable Housing

The Federal Housing Finance Agency announced the members of its Advisory Committee on Affordable, Equitable and Sustainable Housing, which includes several members of the Mortgage Bankers Association.

GSEs Completed 52,154 Foreclosure Prevention Actions in 1Q, FHFA Finds

Fannie Mae and Freddie Mac completed more than 52,000 foreclosure prevention actions in the first quarter, bringing the total to nearly 7 million since the start of conservatorships, the Federal Housing Finance Agency reported.

FHFA Requests Input on Federal Home Loan Bank Affordable Housing Program’s Application Process

The Federal Housing Finance Agency requests input on ways to improve the Federal Home Loan Banks’ processes for applying for Affordable Housing Program funding.

FHFA Seeks Input on Fannie Mae/Freddie Mac Proposed Duty to Serve Underserved Markets Plans

The Federal Housing Finance Agency requests public input on the proposed 2025-2027 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program.