The Federal Housing Finance Agency on Wednesday published a final rule to amend the Duty to Serve Underserved Markets regulation for Fannie Mae and Freddie Mac. The final rule allows Fannie Mae and Freddie Mac’s activities in all colonia census tracts to be eligible for Duty to Serve credit.

Tag: Federal Housing Finance Agency

FHFA Announces Process for Implementing New Credit Score Requirements; MBA Encourages Members to Complete Survey

The Federal Housing Finance Agency recently requested stakeholder input as Fannie Mae and Freddie Mac replace the Classic FICO credit score model with the FICO 10T and the VantageScore 4.0 credit score models, and transition from requiring three credit reports to requiring two credit reports for single-family loan acquisitions.

Industry Briefs Apr. 7, 2023: HUD Extends AFFH Proposed Rules Comment Period by 2 Weeks

HUD extended the public comment date for its Affirmatively Furthering Fair Housing proposed rule by 14 days, to April 24, per a notice in the Federal Register.

Industry Briefs Mar. 30, 2023: Total Expert Updates on Salesforce AppExchange

Total Expert updated its products on Salesforce AppExchange, providing customers new ways to enhance the ROI of their Salesforce integrations.

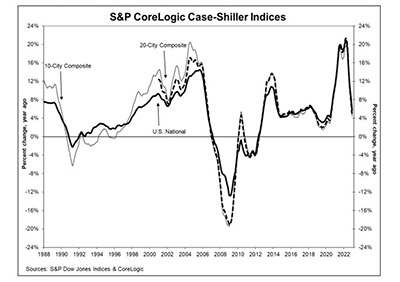

Annual Home Prices Fall for 7th Consecutive Month

Reports from S&P Down Jones Indices, New York, and the Federal Housing Finance Agency, Washington, D.C., saw home prices fall on an annual basis for the seventh consecutive month.

Fannie Mae, Freddie Mac Complete 52,469 4Q Foreclosure Prevention Actions

Fannie Mae and Freddie Mac completed 52,469 foreclosure prevention actions during the fourth quarter, raising the total number of homeowners who have been helped to 6.7 million since September 2008, the Federal Housing Finance Agency reported.

FHFA Delays Effective Date of GSE DTI Ratio-Based Fee to Aug. 1

The Federal Housing Finance Agency on Wednesday announced a 90-day delay in the effective date of the new Loan Level Price Adjustments for certain borrowers with debt-to-income ratios above 40 percent. The new effective date will be for deliveries on or after August 1.

FHFA Delays Effective Date of GSE DTI Ratio-Based Fee to Aug. 1

The Federal Housing Finance Agency on Wednesday announced a 90-day delay in the effective date of the new Loan Level Price Adjustments for certain borrowers with debt-to-income ratios above 40 percent. The new effective date will be for deliveries on or after August 1.

Industry Briefs Mar. 3, 2023: Fitch Ratings Says FHA Premium Cuts ‘Credit Neutral’ for Private Mortgage Insurers

Fitch Ratings, New York, said recently announced reductions in the Federal Housing Authority mortgage insurance premium rates are not expected to have a meaningful credit impact on private U.S. mortgage insurance carriers.

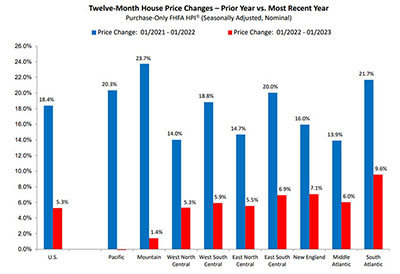

Housing Market Reports: Continued Declines in Home Price Appreciation; Affordability Improves

Three end-of-month home price reports found appreciation declining in many parts of the country, along with increased affordability in many markets.