Craig Riddell is Executive Vice President and Chief Business Officer with LoanLogics, Trevose, Pa. He is responsible for establishing and developing ongoing relationships with LoanLogics’ largest enterprise clientele, as well as leading the company’s Sales, Marketing and Account Management functions.

Tag: Coronavirus

Mark Dangelo: Beware—Watch This Space, Part One

In a world of uncertainty, bankers, lenders and technology firms had grown accustom to traditional measures and approaches honed over decades of lessons learned. Today, the playbooks are gone, and we need to accept that consumers will not wait for us as we say the right things—but execute against a script that has been retired.

MBA: May New Home Purchase Mortgage Applications Up 20% from May, 54% from Year Ago

The home building market continued to show signs of sharp recovery from the coronavirus economy, the Mortgage Bankers Association reported this morning, with June mortgage applications for new home purchases increasing by 54.1 percent from a year ago and by 20 percent from May.

MBA: May New Home Purchase Mortgage Applications Up 20% from May, 54% from Year Ago

The home building market continued to show signs of sharp recovery from the coronavirus economy, the Mortgage Bankers Association reported this morning, with June mortgage applications for new home purchases increasing by 54.1 percent from a year ago and by 20 percent from May.

Survey: Pandemic Forces Nearly Half of Renters to Postpone Homeownership Plans

RentCafe, Santa Barbara, Calif., said its survey of 7,000 renters found although one in 10 renters planned to by a home in 2020, nearly half have now delayed those plans because of the economic impact of the coronavirus pandemic.

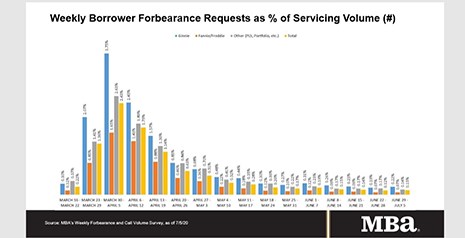

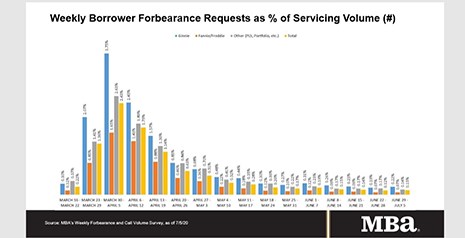

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

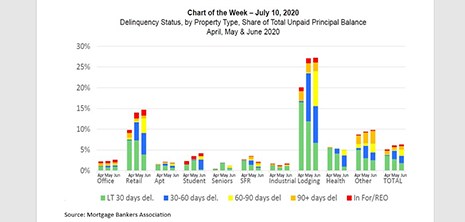

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

Mark Dangelo: Beware—Watch This Space, Part One

In a world of uncertainty, bankers, lenders and technology firms had grown accustom to traditional measures and approaches honed over decades of lessons learned. Today, the playbooks are gone, and we need to accept that consumers will not wait for us as we say the right things—but execute against a script that has been retired.

Faith Schwartz: New Era Borne of Pandemic to Upend Mortgage Costs

As longtime industry participants, we at Housing Finance Strategies contend that the pandemic has created a revolutionary opportunity that we must seize and leverage so that the mortgage business can emerge with higher quality prospective products funded through a drastically reduced cost structure.