MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the fifth week in a row to 6.07%, a 10 basis-point improvement. Ginnie Mae loans in forbearance decreased 116 basis points to 10.56%. At the same time, the forbearance share for portfolio loans and private-label securities increased by 85 basis points to 10.93%, as loans in forbearance were bought out of Ginnie Mae pools and into bank portfolios. The percentage of loans in forbearance for depository servicers dropped to 8.80%, while the percentage of loans in forbearance for independent mortgage bank servicers decreased to 8.10%.

“The share of loans in forbearance continues to decrease, as more workers are brought back from temporary layoffs,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “However, our survey reveals a notable shift in the location of many FHA and VA loans, which have been bought out of Ginnie Mae pools – predominantly by bank servicers – and moved onto bank balance sheets. As a result, there was a sharp drop in the share of Ginnie Mae loans in forbearance, and an offsetting increase in the share of portfolio loans in forbearance. These buyouts enable servicers to stop advancing principal and interest payments, and to work with borrowers in the hope that they can begin paying again before they are re-securitized into Ginnie Mae pools.”

Fratantoni noted 43% of loans in forbearance are now in an extension following their initial forbearance term, while more than 10% of borrowers entered into a deferral plan to exit forbearance – down from 16% the week prior. “For those exiting forbearance over the next several months, we expect to see many of the borrowers with GSE loans to utilize the deferral option”. he said.

Key findings of MBA’s Forbearance and Call Volume Survey – June 29-July 5

- Total loans in forbearance decreased by 21 basis points relative to the prior week: from 8.39% to 8.18%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased from 11.72% to 10.56%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 6.17% to 6.07%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior week: from 10.08% to 10.93%.

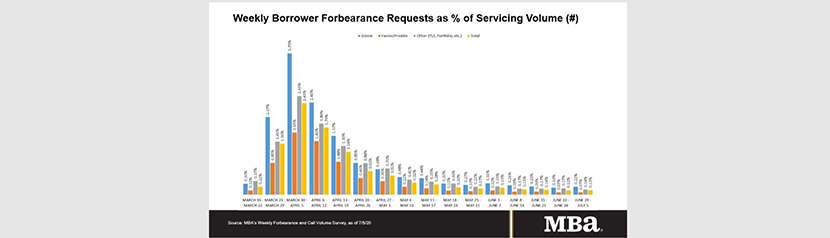

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased from 0.12% to 0.13%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls increased from 6.8% to 7.8%.

- Average speed to answer increased relative to the prior week from 1.6 minutes to 2.5 minutes.

- Abandonment rates increased from 5.0% to 7.3%.

- Average call length decreased from 7.5 minutes to 7.4 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of July 5, 2020:

- Total: 8.18% (previous week: 8.39%)

- IMBs: 8.10% (previous week: 8.33%)

- Depositories: 8.80% (previous week: 9.03%)

MBA’s latest Forbearance and Call Volume Survey covers represents 76% of the first-mortgage servicing market (38.1 million loans).