MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

With the onset of the COVID pandemic, hotels and retail properties were immediately impacted. Smith Travel Research reports that as of July 4th, hotel revenue per available room (revpar) is down 56% from a year earlier (that’s an improvement from previous weeks). Retail sales in April, excluding non-store retailers, were 22% lower than a year earlier. At the same time, the National Multifamily Housing Council reported that in June, a full 96% of renters made their payments, essentially unchanged from a year earlier.

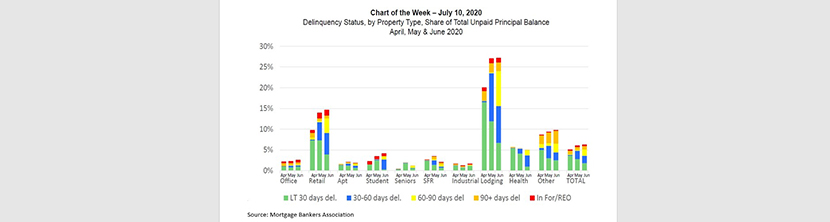

Those stark differences play out in where the commercial mortgage market is – and is not – currently seeing stress. As of June 20, 98.1% of apartment loan balances tracked by MBA were current, as were 97.3% of office property loans, and 98.3% of industrial loans. By contrast, 85.3% of retail and 72.7% of hotel loan balances were current.

The increase in stress among hotel and retail property mortgages was swift but is now slowing. In April, only 3.6% of hotel loans were more than 30 days delinquent. In June, that number stands at 20.5%. But while the overall share of loans delinquent grew from 20% in April to 27% in May, it held steady in June.

Commercial mortgage lending is a business-to-business enterprise, with each property, market and owner bringing a unique set of assets (and liabilities) to the table. Thus far, commercial and multifamily loan performance is tracking the broader impacts that the virus, and our responses to it, are having on the economy.

–Jamie Woodwell (jwoodwell@mba.org)