Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

Tag: CoreLogic

MBA CONVERGENCE Partner Profile: Pete Carroll, CoreLogic

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

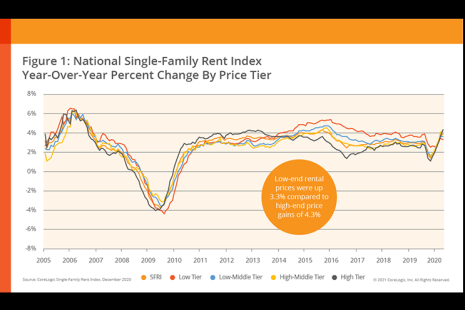

Strong Demand Fuels Single-Family Rent Growth

Occupancy rates for single-family rental homes have reached a generational high, driving up SFR rent growth, two new reports said.

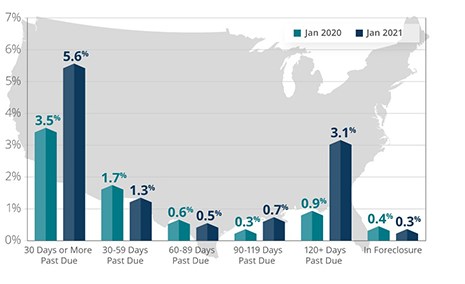

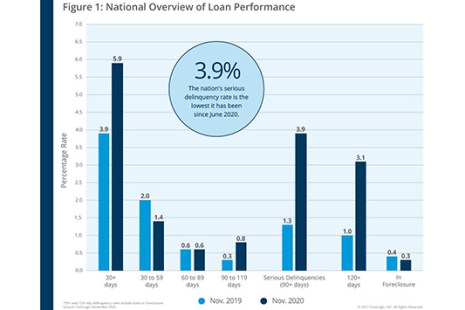

CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

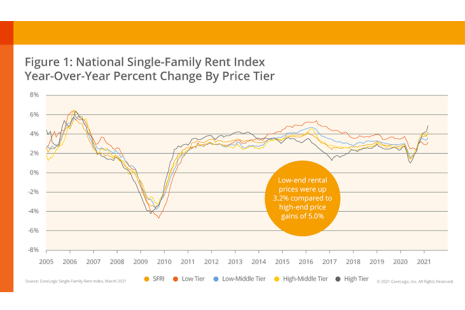

‘Quick Start’ for 2021 Single-Family Rent Growth

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.8 percent year-over-year in January, up from a 2.9 percent annual increase a year ago.

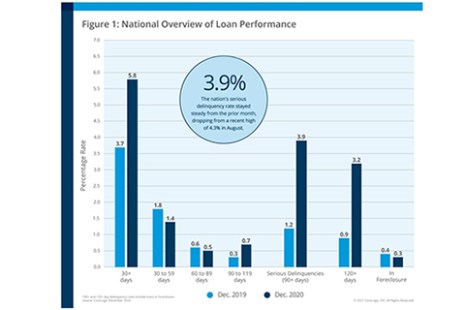

2020 Mortgage Delinquencies See Record Highs—and Record Lows

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

Industry Briefs Monday Feb. 22 2021

Redfin, Seattle, announced it entered into an agreement to acquire RentPath, an Atlanta-based owner of ApartmentGuide.com, Rent.com, and Rentals.com, for $608 million in cash.

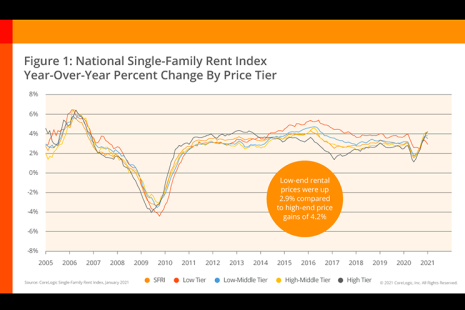

Single-Family Rents Grow, But at Disparate Rates

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.8 percent year-over-year in late 2020, up from 2.9 percent growth a year before.

Industry Briefs Feb. 16 2021

LodeStar Software Solutions announced an integration with Mortgage Coach, creator of the Total Cost Analysis Borrower Conversion Platform. This integration allows lenders of any size to include accurate closing provider fees when creating a Total Cost Analysis for borrowers.

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

Ahead of this Thursday’s 4th Quarter National Delinquency Report from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.