CoreLogic, Irvine, Calif., released additional loss estimates for Hurricane Ida, following its initial release estimating between $27 billion and $40 billion in insured and uninsured losses from wind, storm surge and inland flooding in Louisiana and Mississippi.

Tag: CoreLogic

CoreLogic: Hurricane Ida Leaves $27-40 Billion in Losses

CoreLogic, Irvine, Calif., estimated residential and commercial wind, storm surge and inland flooding loss estimates for Hurricane Ida in Louisiana, Mississippi and Alabama at $27-$40 billion.

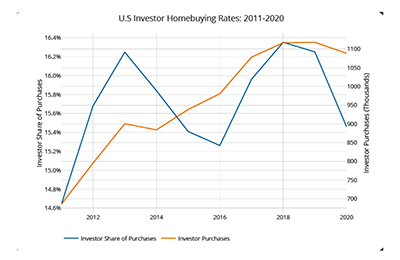

CoreLogic Finds Shifting Market Dynamics Since 2011

Small investors make up a growing share of single-family real estate purchases and continue to gain market share at the expense of their larger counterparts, reported CoreLogic, Irvine, Calif.

Industry Briefs Aug. 27, 2021: Home Lending Pal Raises $2M

The Mortgage Collaborative, San Diego, announced the TMC Emerging Technology Fund LP led a pre-Series A investment round in Home Lending Pal, a technology-enabled marketplace that focuses on fair lending practices.

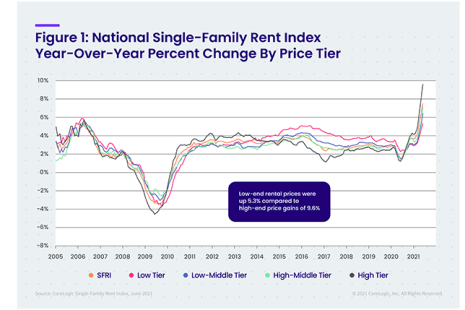

Single-Family Rent Growth Up More Than Five-Fold Year-over-Year

CoreLogic, Irvine, Calif., said single-family rent growth reached 7.5% year-over-year in June, up from a 1.4% year-over-year increase a year ago.

CoreLogic: Mortgage Fraud Increases After Brief Dip

CoreLogic, Irvine, Calif., reported mortgage fraud is increasing again after a brief dip last year.

Industry Briefs Aug. 6, 2021

CoreLogic, Irvine, Calif., said its analysis of homebuyer migration trends in 2020 found coastal metro areas in Florida such as Lakeland and Tampa ranking highest, as many moved away from large coastal areas such as New York, Los Angeles and San Francisco.

Industry Briefs Aug. 5, 2021

CoreLogic, Irvine, Calif., said its analysis of homebuyer migration trends in 2020 found coastal metro areas in Florida such as Lakeland and Tampa ranking highest, as many moved away from large coastal areas such as New York, Los Angeles and San Francisco.

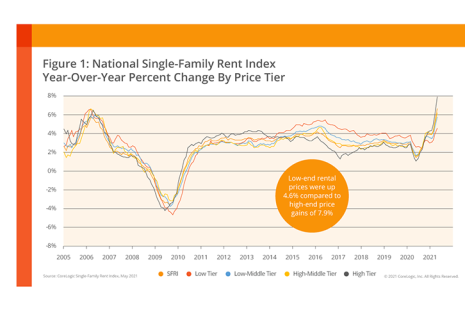

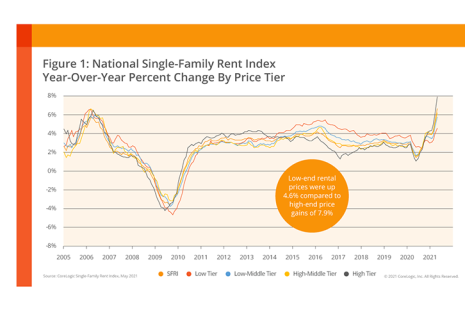

Domino Effect: Single-Family Rent Growth Rate Spikes in May as Housing Economy Challenges Persist

CoreLogic, Irvine, Calif., said single-family rent growth reached 6.6% year-over-year in May, up from a 1.7% year-over-year increase in January 2020.

Domino Effect: Single-Family Rent Growth Rate Spikes in May as Housing Economy Challenges Persist

CoreLogic, Irvine, Calif., said single-family rent growth reached 6.6% year-over-year in May, up from a 1.7% year-over-year increase in January 2020.