Single-Family Rents Grow, But at Disparate Rates

Chart courtesy of CoreLogic

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.8 percent year-over-year in late 2020, up from 2.9 percent growth a year before.

Annual SFR asset rent growth slowed early in the COVID-19 pandemic but picked up steadily in the latter half of the year and reached pre-pandemic growth rates by October, said CoreLogic Principal Economist Molly Boesel.

“In the final months of 2020, single-family rents posted the highest increases in over four years,” Boesel said. “However, single-family rent price reaction to the pandemic and resulting recession differed greatly across metros. While rents in the Southwest U.S. strengthened, in some areas of the country–in particular, areas relying heavily on tourism–rents softened.”

The CoreLogic Single-Family Rent Index report said 2020 was a “noteworthy” year for the single-family rental market. “Renters sought more space and detached properties to weather the pandemic, which kept rent prices of single-family properties on the rise and multifamily rents tumbling,” the report said. “While single-family rents increased on average, some areas of the country experienced lower growth and even drops in rents.”

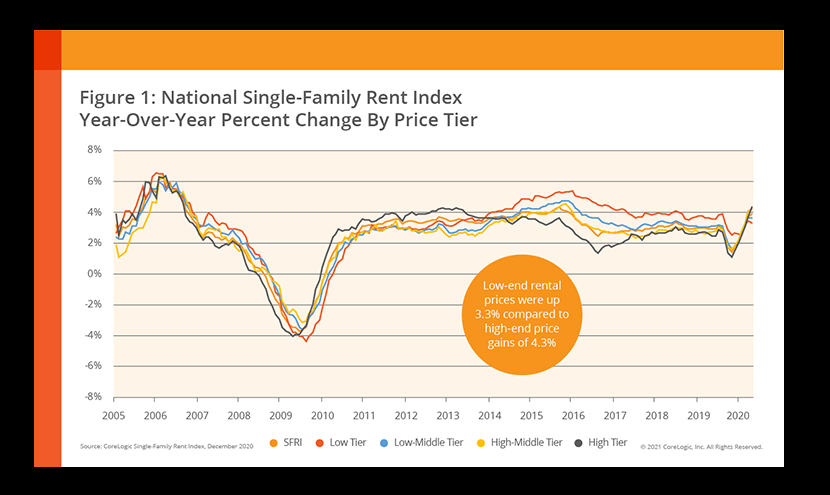

CoreLogic examines four rental price tiers. In 2020, all four price tiers saw a slowdown in rent growth due to the pandemic-induced recession. Then the three highest price tiers returned to pre-pandemic growth rates within six months. In December, rent increases in the lowest tier still lagged behind its year-before rates. National single-family rent growth across the four tiers, and the year-over-year changes, were:

–Lower-priced (75 percent or less than the regional median): 3.3 percent, down from 3.5 percent in December 2019.

–Lower-middle priced (75 percent to 100 percent of the regional median): 3.6 percent, up from 3.1 percent in December 2019.

–Higher-middle priced (100 percent to 125 percent of the regional median): 4.1 percent, up from 2.7 percent in December 2019.

–Higher-priced (125 percent or more than the regional median): 4.3 percent, up from 2.4 percent in December 2019.

Among the 20 largest metros–and for the 25th consecutive month–Phoenix saw the highest year-over-year increase in single-family rents in December at 10.7 percent. Tucson, Ariz. ranked second with a 9.5 percent rent price growth, followed by Charlotte, N.C. at 7.1 percent.

Conversely, Boston posted a 7.2 percent annual decline in rent prices. The city has experienced the largest decrease among all 20 metros’ rent prices for the past five months. CoreLogic attributed the drop to the city not seeing its typical influx of college students in the fall.

Unemployment rates, while fell after April’s significant jump, improved at different rates across the country in December, creating a disparate impact in rent price growth. For example, unemployment in Austin, Texas, decreased to 5.3 percent in December while Honolulu’s unemployment decreased to 8.4 percent. And while year-over-year single-family rent in Austin grew by 4.7 percent in December, it decreased by 0.1 percent in Honolulu.

“As states begin managing the administration of vaccines as well as mitigating continued unemployment concerns, [single-family rental] rent prices will likely continue to experience mixed growth rates in metros across the nation,” the report said.