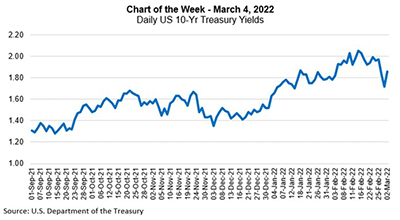

Prior to Russia’s invasion, 10-Year Treasury yields broke higher — reaching 2.05% on February 15. Since then, they have fallen to as low as 1.72% but have rebounded somewhat, underscoring both the downside risk and volatility markets are facing.

Tag: 10-Year Treasuries

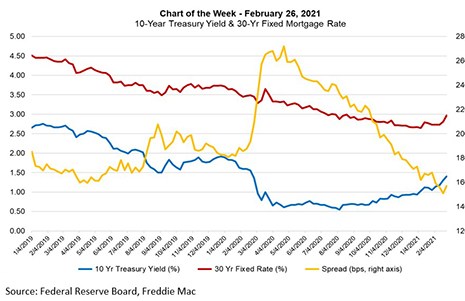

MBA Chart of the Week: 10-Year Treasuries and 30-Year Fixed Rates

This week’s chart shows the recent climb in rates, and the spread between the 30-year mortgage rate, as surveyed by Freddie Mac, and the 10-year Treasury yield. As the 10-year has risen, so has the 30-year fixed rate, which has gone up 24 basis points since the beginning of February.

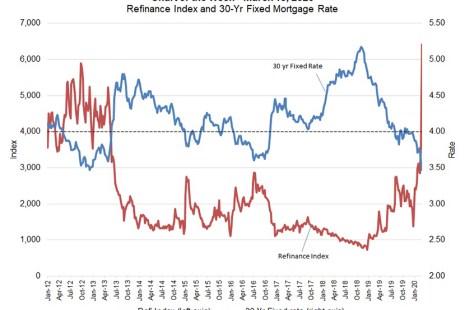

MBA Chart of the Week: Refinance Index and 30-Year Fixed Mortgage Rate

Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil and volatility caused by the uncertainty around the spread of the coronavirus.

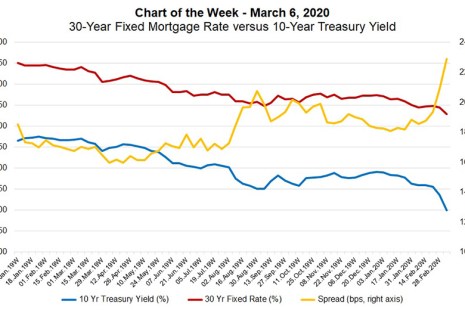

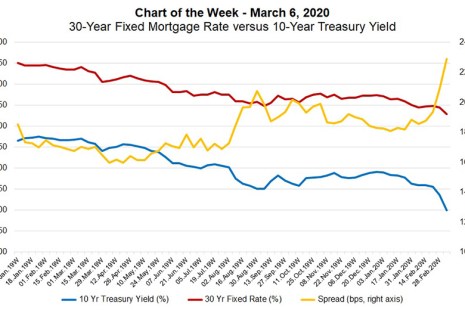

MBA Chart of the Week: 30-Year Fixed Rate vs. 10-Year Treasury

The yield on U.S. 10-year Treasuries fell to record lows last week, driven by increasing concerns regarding the spread of the coronavirus and its impact on the global and U.S. economy. Just last week, there has been an increase in occurrences of business shutdowns, travel restrictions and potential spending reductions.

MBA Chart of the Week: 30-Year Fixed Rate vs. 10-Year Treasury

The yield on U.S. 10-year Treasuries fell to record lows last week, driven by increasing concerns regarding the spread of the coronavirus and its impact on the global and U.S. economy. Just last week, there has been an increase in occurrences of business shutdowns, travel restrictions and potential spending reductions.

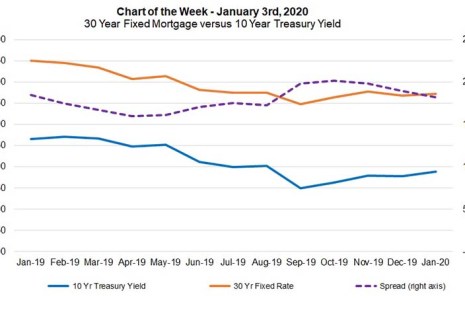

MBA Chart of the Week: 30-Year Fixed Mortgage vs. 10-Year Treasuries

This week’s chart shows the narrowing of the spread between the 30-year fixed mortgage rate and the 10-year Treasury yield–from a high of 208 basis points in September to 183 basis points at the end of December.

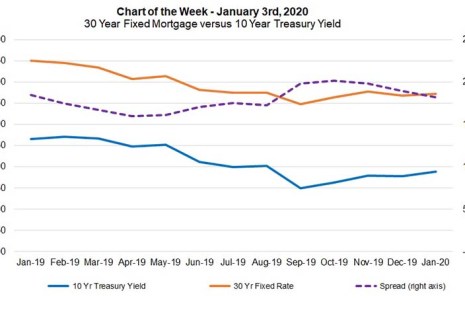

MBA Chart of the Week: 30-Year Fixed Mortgage vs. 10-Year Treasuries

This week’s chart shows the narrowing of the spread between the 30-year fixed mortgage rate and the 10-year Treasury yield–from a high of 208 basis points in September to 183 basis points at the end of December.