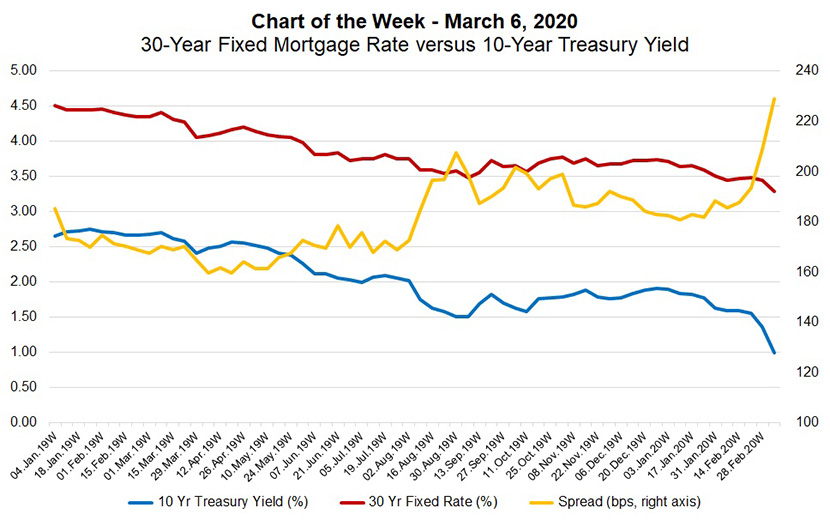

MBA Chart of the Week: 30-Year Fixed Rate vs. 10-Year Treasury

The yield on U.S. 10-year Treasuries fell to record lows last week, driven by increasing concerns regarding the spread of the coronavirus and its impact on the global and U.S. economy. Just last week, there has been an increase in occurrences of business shutdowns, travel restrictions and potential spending reductions.

The 30-year fixed mortgage rate, as published by Freddie Mac from its Primary Mortgage Market Survey, which goes back to 1981, fell to a record low this week, at 3.29 percent. Refinance demand spiked last week as rates fell, with the MBA Weekly Applications Survey showing conventional refinance applications increasing more than 30 percent from the week before. Given the further drop in Treasury rates this week, we expect refinance activity will increase even more until fears subside and rates stabilize.

While mortgage rates have fallen with Treasury yields, they have not fallen in step–the spread between them has widened. Historically, this spread was around 170 basis points, but over the past two weeks, it has gone from 190 basis points to 230 basis points.

The reason? Lenders are attempting to cope with refinance activity far exceeding their capacity, and investor demand for mortgage-backed securities slows as the potential for more prepayments increase. As it takes time for lenders to increase staffing or reallocate their resources to meet this inflow of refinance activity, we will likely see spreads remain at these wider levels for the immediate future.

(Mike Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)