MBA: Commercial/Multifamily Lending Expected to Fall in 2022 Amid Ongoing Economic Uncertainty

The Mortgage Bankers Association, in an updated baseline forecast, said total commercial and multifamily mortgage borrowing and lending is expected to fall to $766 billion this year, down 14 percent from 2021 totals ($891 billion).

MBA Advocacy Update Oct. 3, 2022

On Wednesday, in a follow-up to last week’s White House meeting, MBA President and CEO Bob Broeksmit, CMB, sent a letter to key Biden administration officials, reiterating MBA’s recommendations on addressing housing supply and affordability challenges across the country. House and Senate lawmakers passed a Continuing Resolution ahead of the September 30 government funding deadline to avert a federal shutdown.

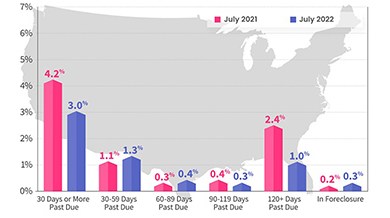

CoreLogic: Mortgage Delinquencies Post 16th Consecutive Annual Decline

CoreLogic, Irvine, Calif., said Mortgage Delinquencies fell in July, marking the 16th consecutive annual drop. The Loan Performance Insights Report said foreclosures rose slightly from a year ago in two-thirds of metro areas, but the national rate remains near a record low.

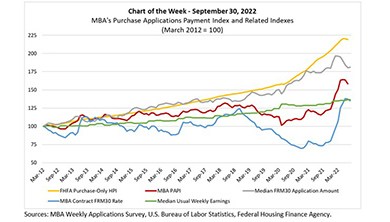

MBA Chart of the Week Sept. 30, 2022: MBA Purchase Applications Payment Index

Last week, the Federal Housing Finance Agency released its Purchase-Only House Price Index for July. The HPI was down 0.6% from the previous month, although up 13.9% from July 2021. The HPI has increased by nearly 120% since March 2012 (yellow line), and is up 39% since the start of the COVID-19 pandemic in March 2020.

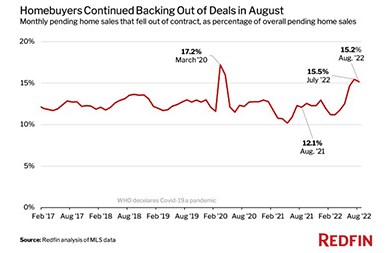

15% of August Home Purchase Agreements Fall Through

Redfin, Seattle, reported 64,000 home-purchase agreements fell through in August, equal to 15.2% of homes that went under contract that month. That’s up from 12.1% a year earlier and is comparable with July’s revised rate of 15.5%.