CoreLogic: Mortgage Delinquencies Post 16th Consecutive Annual Decline

CoreLogic, Irvine, Calif., said Mortgage Delinquencies fell in July, marking the 16th consecutive annual drop. The Loan Performance Insights Report said foreclosures rose slightly from a year ago in two-thirds of metro areas, but the national rate remains near a record low.

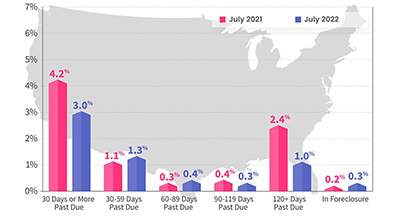

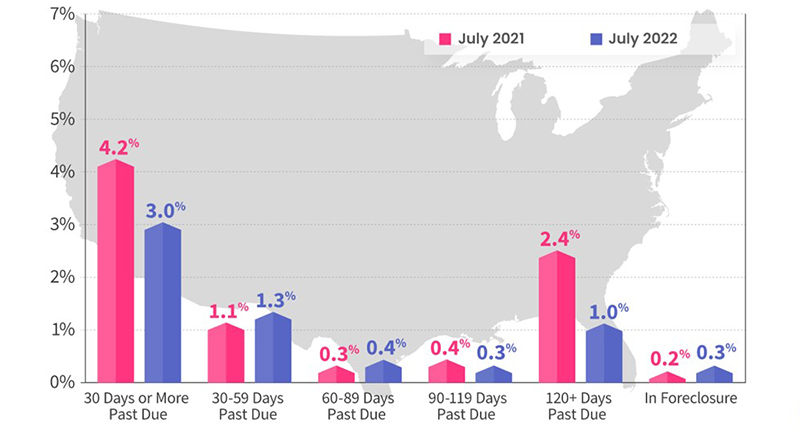

The report said for July, 3% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 1.2 percentage point decrease compared to 4.2% in July 2021. Other report findings:

–Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.1% in July 2021.

–Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in July 2021.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.3%, down from 2.8% in July 2021 and a high of 4.3% in August 2020.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, up from 0.2% in July 2021.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, up from 0.6% in July 2021.

The report noted although overall U.S. mortgage delinquencies crept up again in July from earlier in 2022, they declined for the 16th straight month year over year and remained near historic lows. The national foreclosure rate has held steady at 0.3% since March but rose by 0.1 percentage point from July 2021. This slight bump mirrors metro-level trends, with almost two-thirds of areas that CoreLogic tracks posting small annual foreclosure gains.

CoreLogic Principal Economist Molly Boesel said the minor uptick in foreclosures could be due to mortgage forbearance periods and moratoriums ending for some homeowners, while the increase in delinquencies could indicate that inflation is negatively impacting others’ abilities to make monthly payments.

“Early-stage delinquencies are showing a small but clear increasing trend on a month-over-month and year-over-year basis,” Boesel said. “While the share of mortgages that are 30 to 89 days past due remains below the pre-pandemic level, the slight increase is occurring in most areas of the country and could indicate that more borrowers are having trouble making their monthly payments.”

The report said all states posted annual declines in their overall delinquency rates in July. States with the largest declines were Hawaii and Nevada (both down 2.3 percentage points), New Jersey (down 2.1 percentage points) and New York (down 2.0 percentage points), the third consecutive month that these states have led the country for delinquency declines. Remaining states, including the District of Columbia, registered annual delinquency rate drops between 1.9 percentage points and 0.2 percentage points.

All but eight U.S. metro areas posted at least a small annual decrease in overall delinquency rates, with increases in those metros ranging from 0.1 percentage points to 0.4 percentage points. All U.S. metro areas posted at least a small annual decrease in serious delinquency rates, with Odessa, Texas (down 4.7 percentage points), Laredo, Texas (down 3.7 percentage points) and Kahului-Wailuku-Lahaina, Hawaii (down 3.6 percentage points) posting the largest decreases.