BREAKING NEWS

Applications Drop in MBA Weekly Survey

Purchase applications rose, but a sharp drop in refinance applications led to an overall drop in mortgage applications last week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 21.

New home sales took a double hit yesterday, according to HUD and the Census Bureau: not only did April new home sales fall by nearly 6 percent, March sales revised sharply downward by more than 10 percent.

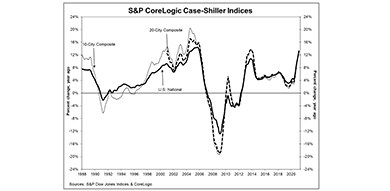

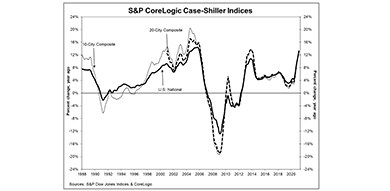

Home prices continued to post double-digit annual gains amid a red-hot spring housing market, according to the Standard & Poor’s CoreLogic Case-Shiller Indices.

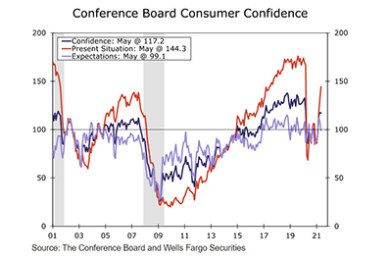

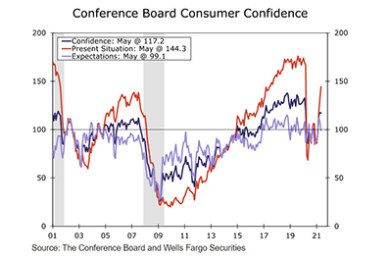

The Conference Board, New York, reported its monthly Consumer Confidence Index held steady in May, following a gain in April. The Index now stands at 117.2, down marginally from 117.5 in April.

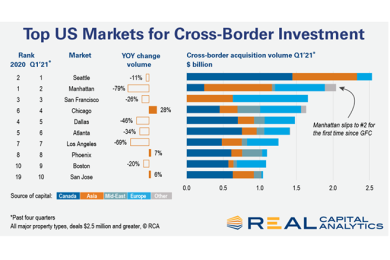

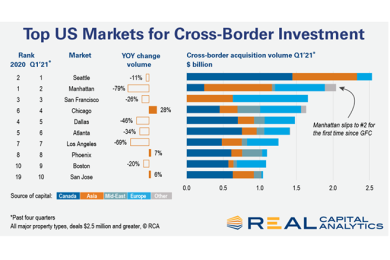

Seattle surpassed Manhattan to become the leading U.S. market for cross-border investment, reported Real Capital Analytics, New York.

The largest risk in the real estate lending industry is the collateral securing the loan. Having thorough appraisal and evaluation programs in place is the best insurance to mitigate that risk. ServiceLink’s Laura Raposo explains how lenders can identify and select an AMC with an affirmed commitment to compliance, and the financial strength and stability to adhere to that commitment.

Meridian Capital Group, New York, arranged $171.6 million to refinance newly constructed multifamily property One Museum Square in Los Angeles, on behalf of JH Snyder Co., Los Angeles.

When it comes to closing, there are lots of moving parts involved that have traditionally been in person or on physical paper. However, things had to change rapidly. Although a challenge in the beginning, it has also presented a large opportunity and given borrowers and lenders more flexibility in how they complete tasks.

In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008. Until 2020 the surveys were conducted face to face at the MBA National Secondary Market Conference every May and again in October at the MBA’s Annual Convention. However, the pandemic has shifted both sets of contacts to the telephone last year and this.

Peter Muoio is head of SitusAMC’s Insights division, a provider of technology and services to the real estate finance industry. He has more than 30 years of research and analytics experience in the commercial real estate industry.

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations. He founded LenderClose in 2015.

Notarize, Boston, announced Roger W. Ferguson Jr., joined its board of directors. His career spans more than four decades, including 13 years as CEO of TIAA.

One third of the way into 2021 we find ourselves immersed in questions and wonderment as to what the future of the residential finance business will look like. Originators join with servicers, investors, and borrowers all wondering what comes next. What does our future hold?